14 Jun 2016

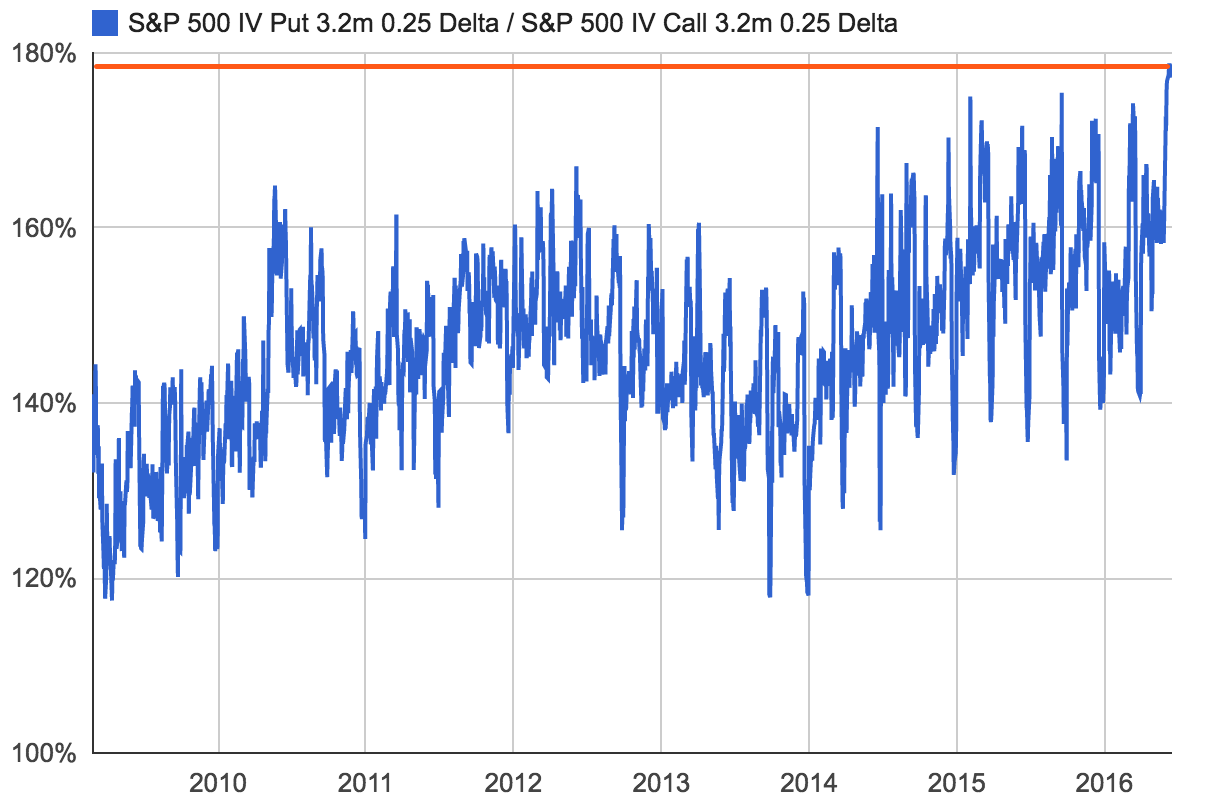

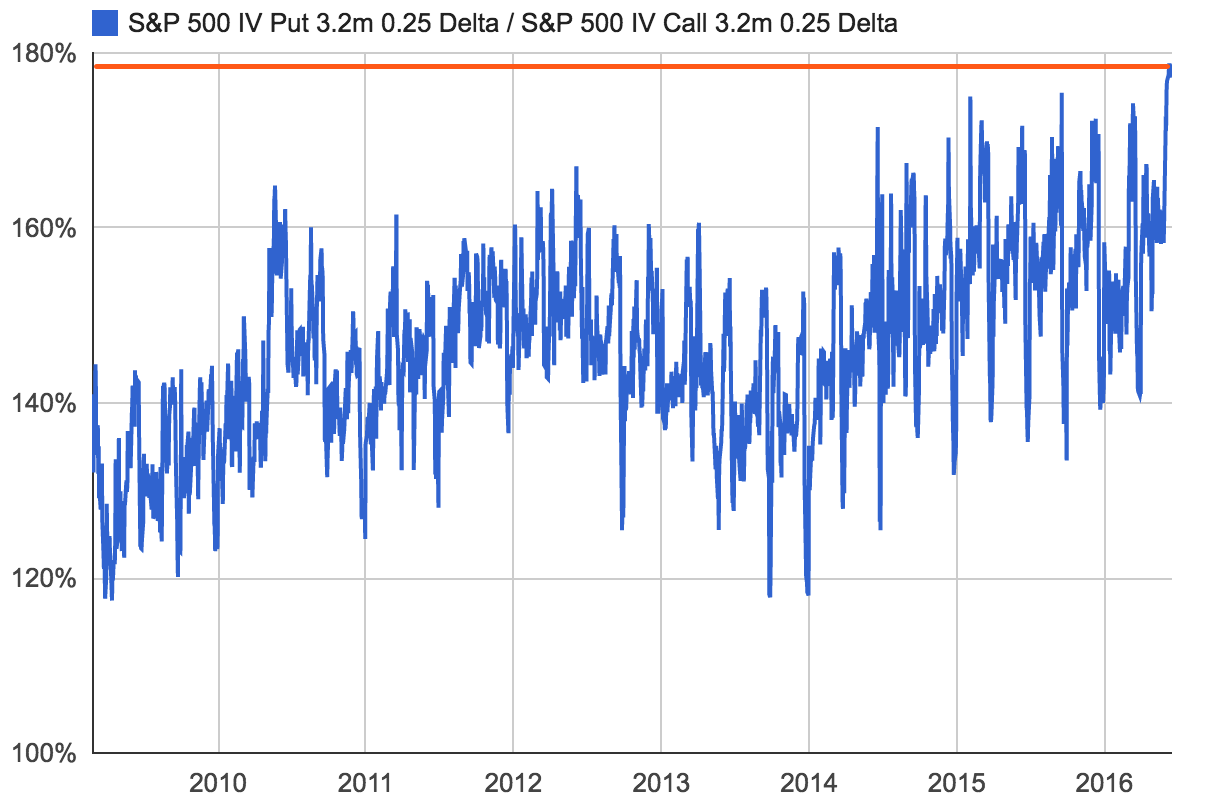

As the Fed meeting kicks off and we lead up to the Brexit vote, put protection

is trading at the most expensive levels relative to upside calls over the past

seven years (chart below). But with put option transaction volumes healthily

below their median levels, the upcoming news events haven’t led to a notable surge

in investors looking to hedge equities. With many staying on the sidelines,

today’s options pricing presents opportunities with attractive backtesting results

depending on your directional view:

Longs: Consumer Discretionary (XLY) Risk Reversals

Put writers: Biotech (XBI), Nike (NKE)

Covered call writers: Twitter (TWTR), Viacom (VIAB)

Hedgers: S&P 500 Put Spreads

Tags: options backtesting • options market analysis • Federal Reserve • option volumes

08 Jun 2016

Options backtesting with targets and stop losses

Targets and stop losses have been your most requested features over the last couple months, and we’re very

excited to finally bring them to you. You can now set targets and stops for every backtest you run on Volatility,

even systematic strategies and earnings trades. You can also choose to include or exclude estimated liquidation

costs for stop losses.

Try it now and send us your feedback!

Backtest your custom prices

Another important backtesting update we’re releasing today is the ability to enter custom prices for options in

your backtests. This allows you to easily backtest and evaluate live prices you see in the market intraday.

A couple other benefits include helping you find the best levels to place your limit orders or helping you

better understand the impact of bid/ask spreads on your strategy’s performance.

Public beta and thank you

We are also announcing a shift from private to public beta today. Your friends and colleagues can now

more easily try Volatility, and we’re looking forward to hearing their feedback.

Finally, we want to sincerely thank you for being a part of our private beta and for helping us make Volatility

into an essential tool for options traders. Looking forward, we will be launching Volatility out of beta soon.

To show our appreciation for all your feedback and help, we’re offering you discounts

on plans for a limited time. Learn more here.

Tags: options backtesting • stop losses • profit targets • beta • updates

10 May 2016

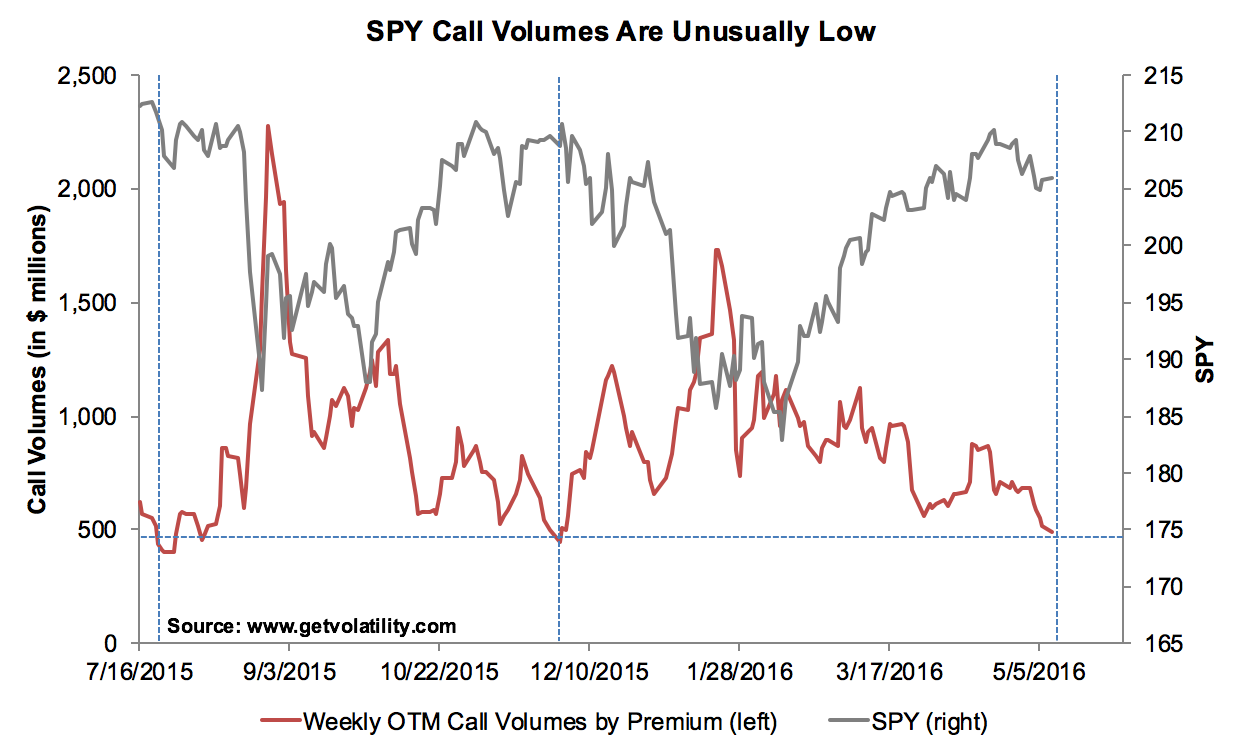

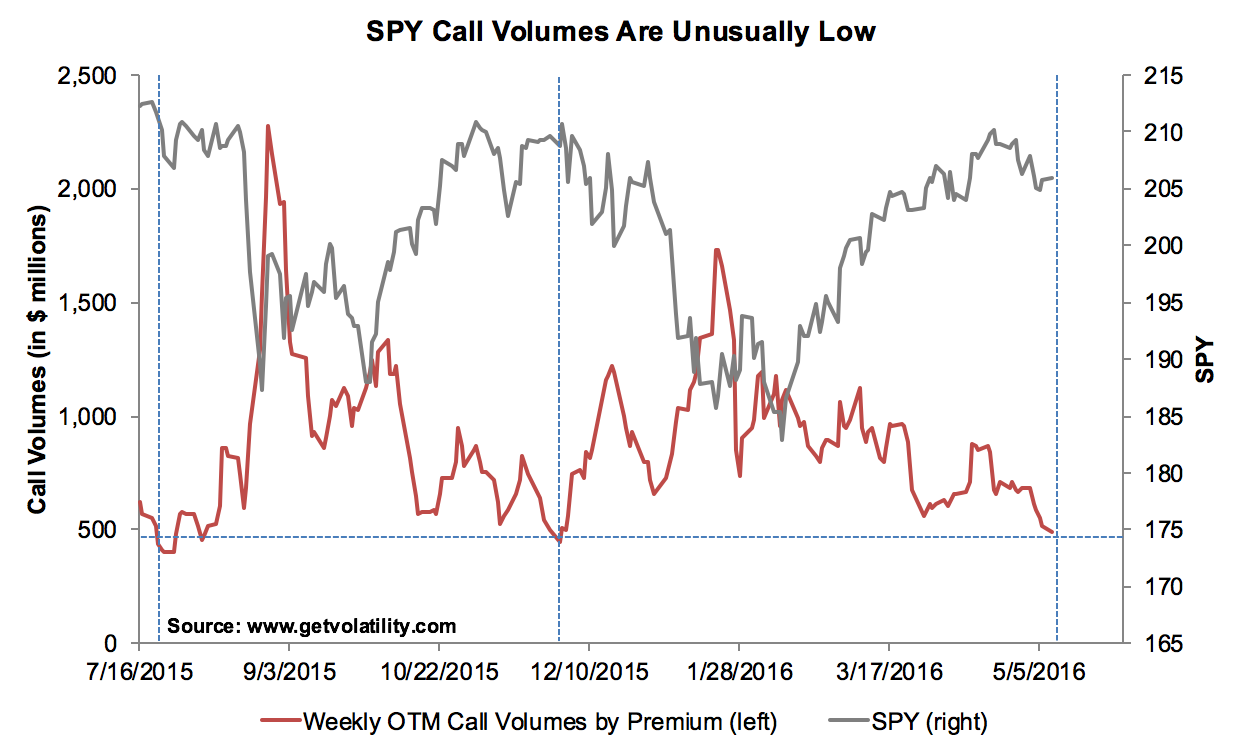

As the S&P 500 stagnates in the 2,040 to 2,100 range, bullish index option volumes have dropped to the same low levels

that occurred just before the 10% market declines in February and August (chart below). Interestingly, the lack of

upside buying has not coincided with increased buying of put protection, indicating that many may be sitting on the

sidelines instead of putting capital to work. With at-the-money volatilities low and skews high, hedgers can find

attractively priced put spreads

and longs can find well-priced call spreads.

Today’s attractive put-writes and covered calls

3m 10% OTM by historical success probability and backtested expected value. Click the stock to view backtesting results.

Put-writes: Allergan (85.3%; 2.6%),

Viacom (85.0%; 2.3%),

Gilead (87.8%; 2.0%).

Covered calls: Twitter (87.7%; 4.9%),

Alibaba (83.5%; 1.0%),

Aloca (85.0%; 1.0%).

Tags: options market analysis • option volumes • call spreads • put spreads • put writing • covered calls • SPY

13 Apr 2016

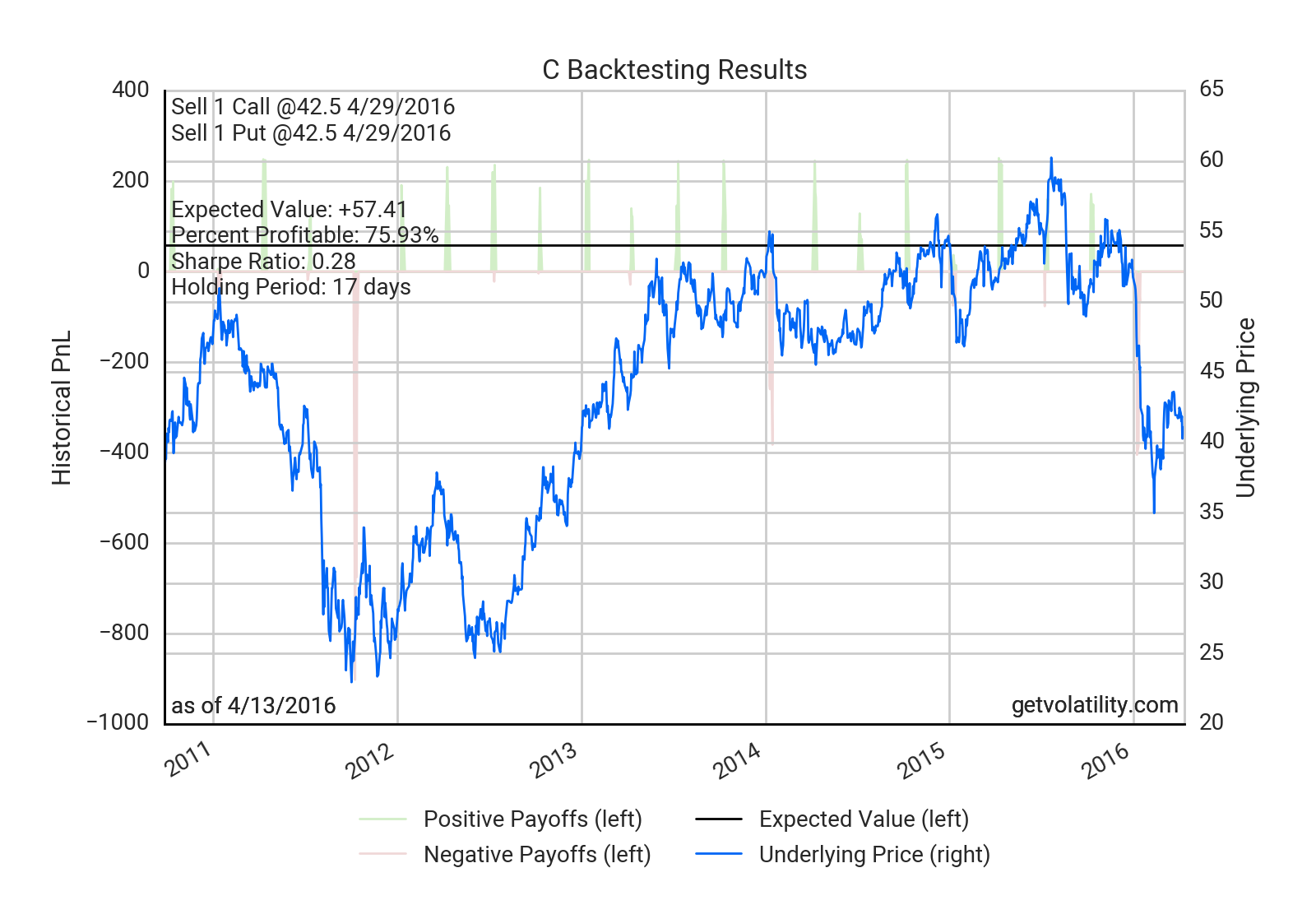

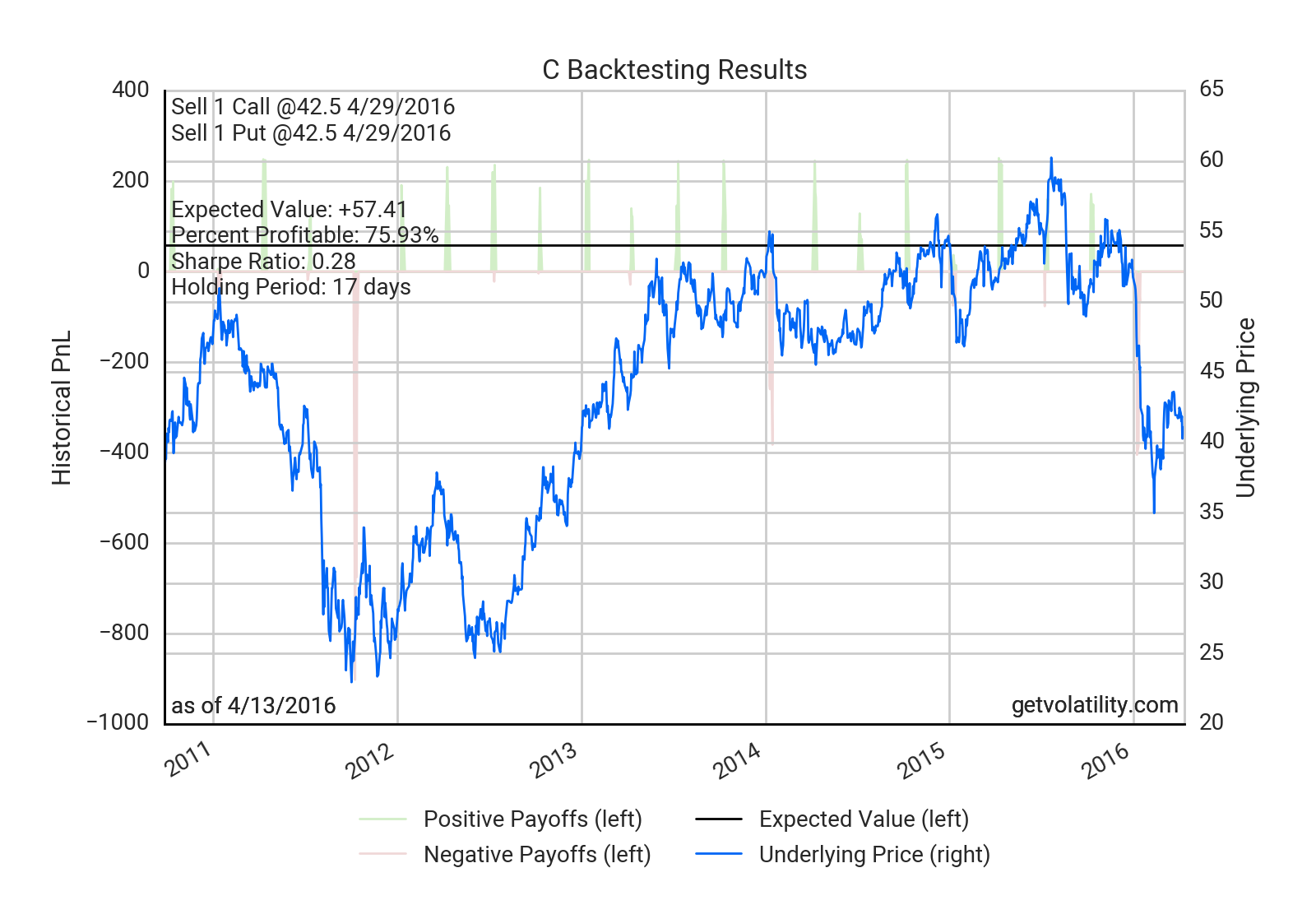

We’re excited to announce two new features today as earnings season kicks off. The first feature is the ability to

analyze earnings strategies with just a few clicks. We’ve assembled a large amount of historical earnings data which

you can now leverage to backtest your earnings trades.

As an example, Citigroup reports earnings Friday, and you can determine in seconds that selling short-term straddles

ahead of their reports would have been profitable over 16 of the past 21 earnings releases (76% historial success rate)

at today’s pricing. You can now quickly craft and optimize your earnings strategies.

We’ve also included the ability to exclude earnings dates from backtests, which is very useful for evaluating

systematic strategies that you actively avoid trading around earnings announcements.

Try it today. Click on Earnings within Advanced Parameters.

Industry filtering

We also added industry filtering to the Equity, Put Writing, and Covered Call screens.

This makes it easier to find the most attractive technology put-writes or the cheapest bank hedges, for example.

Many of you have been avoiding energy names lately, and this also lets you quickly remove them from the screens.

Interested in private beta access? Sign up here.

Tags: updates • beta • options backtesting • earnings

29 Mar 2016

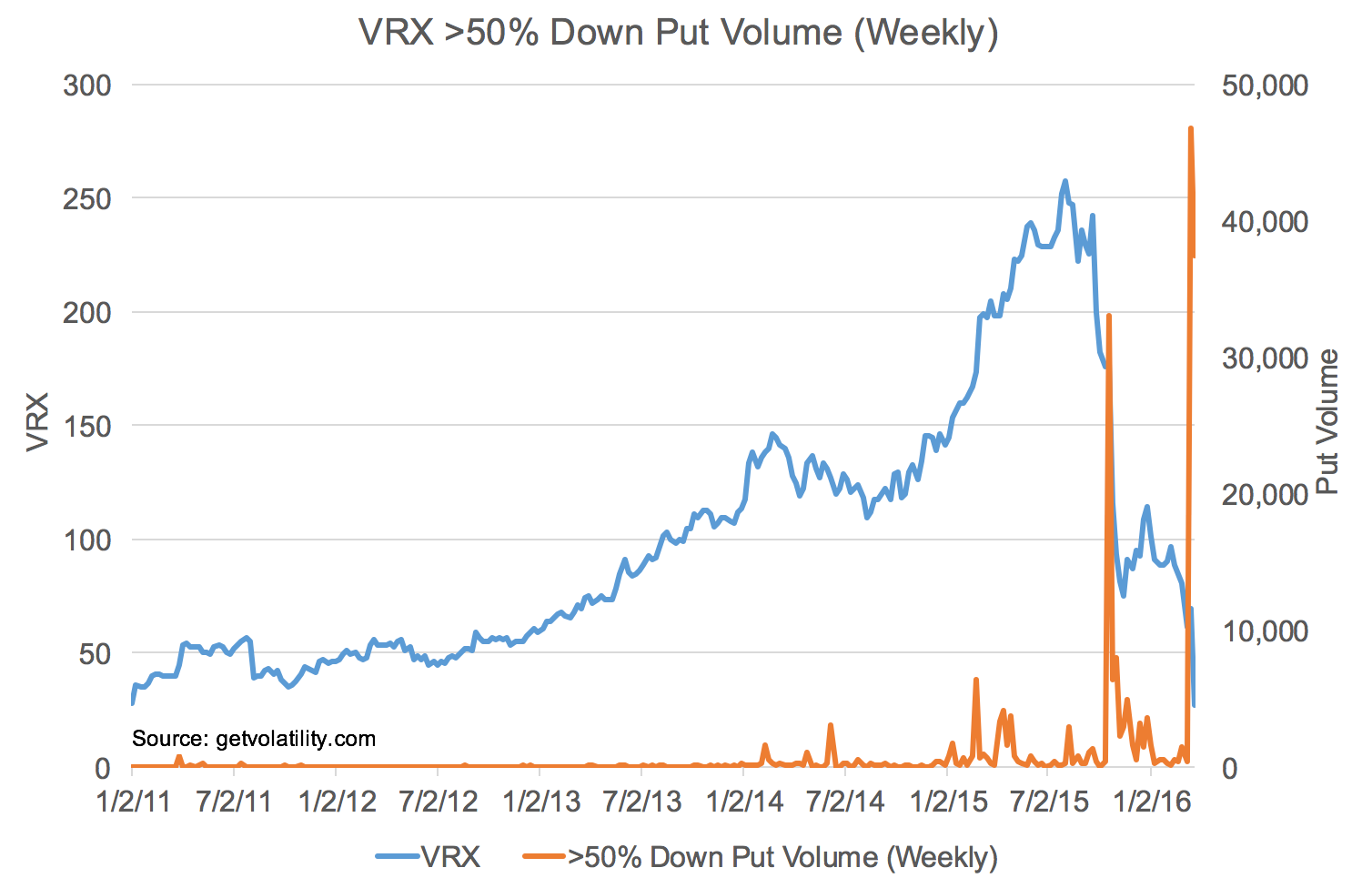

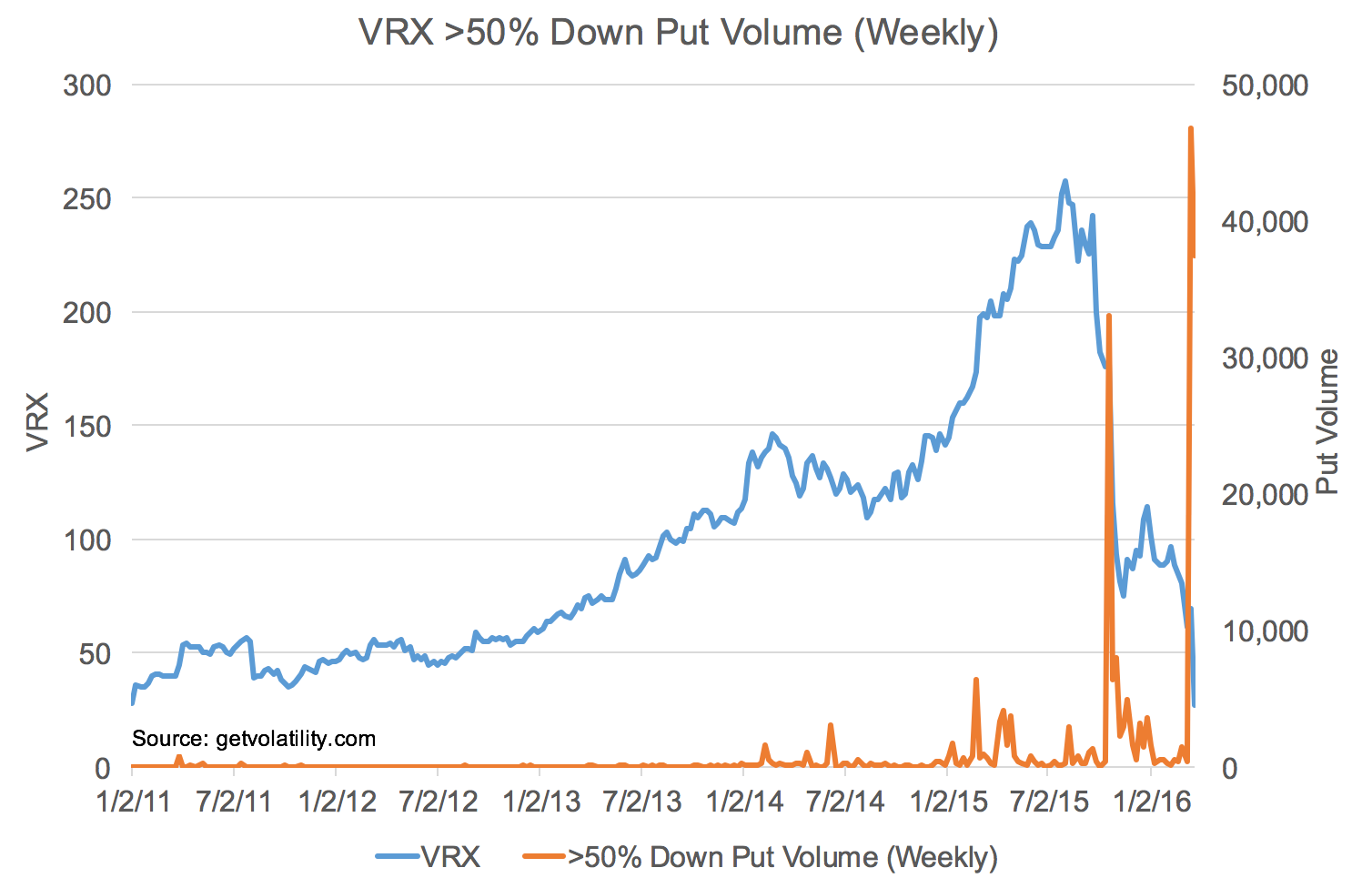

Puts struck at the scary level of 2.50 started trading on Valeant in the last several days, and they’ve already

accumulated an open interest of 5,000 contracts. Options traders are positioning for a large decline more than ever

before with puts struck >50% down trading in record size, breaking October’s activity (chart below).

The majority of the today’s bearish volume is centered on 7.50 and 10.00 puts expiring in April and May,

which are pricing in a roughly 12% chance of 10.00 by expiry. They would have a ~3x return in a repeat of the

September through November 70% decline.

Tags: options market analysis • Valeant