22 Mar 2016

Strategy payoff grids added to every backtest

We are happy to announce our latest addition to Volatility. Forward-looking grids which show profit and loss

estimates by underlying price and time are now shown alongside every backtest. These intuitive grids make it

even easier to contextualize when your strategy will succeed and what risks you’re taking all the way through

expiry. You can also re-calculate the entire future payoff grid under custom implied volatilities.

Try it now.

Negative put selling expected value

Short-dated implied volatilities have compressed significantly over the past two weeks, so much so that

selling 1-month 5-10% OTM puts at today’s pricing now has negative expected value on a

historical backtest.

On the major indices, put sellers are collecting 45% less premium (on average) than just four weeks ago and 25%

less than the median over the past seven years. Premium sellers may be better served looking at select single names.

We highlight a few below.

Vols that remain high: Tesla (upcoming Model 3 unveil),

Hewlett Packard,

Activision Blizzard.

Historically attractive put-writes: S&P Biotech,

Nike,

Zoetis.

Historically attractive covered calls: LinkedIn,

Alibaba,

Viacom.

Interested in private beta access? Sign up here.

Tags: updates • beta • options backtesting • payoff grids • options market analysis

15 Mar 2016

Options traders are expecting an unusually low market impact from the Fed this week. S&P 500 options imply an expected

price range of $1989 to $2051 (1.6% move)

through Friday. Since 2009, 42% of weeks (159/377) had realized moves greater than 1.6%, and the average move across all

weeks was 1.7%. Is this really just going to be another average week?

Traders aren’t only expecting U.S. markets to be unusually sleepy. Short-term vols for the

euro,

IG corporate bonds,

Treasuries,

Euro Stoxx, and even

Chinese equities

are all sub-35th percentile over the past year. A whole host of macro and single-name

upside and

protection plays

that would have been prohibitively expensive just a few weeks ago are now tenable again.

Notable options markets

Vols that remain high:

S&P Metals and Mining,

Brazil,

CAD/USD.

Historically attractive put-writes:

Freeport McMoran,

Tesla,

S&P Biotech.

Historically attractive covered calls:

TripAdvisor,

GameStop,

Viacom.

Interested in private beta access? Sign up here.

Tags: options market analysis • Federal Reserve • S&P 500

08 Mar 2016

Our newest trading idea generation feature helps you quickly find related markets that may be better expressions of your

market view. Every Opportunities page now has a Correlated Markets section which lists macro and single-name equity markets

that move in tandem with the security you’re evaluating. This feature will get your creative juices flowing, and you will

likely discover other liquid markets that offer more attractive pricing for your view. Before you place your next trade,

make sure you check the correlated markets.

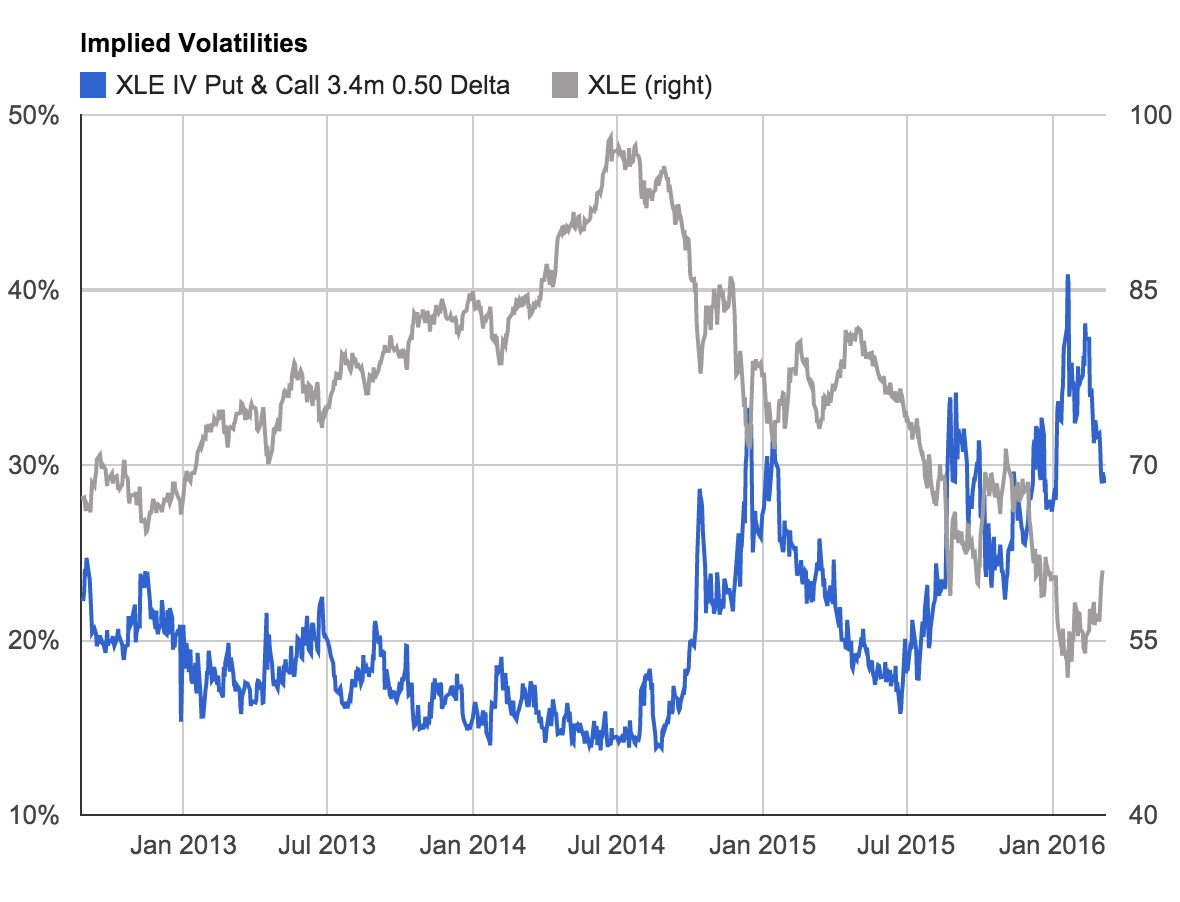

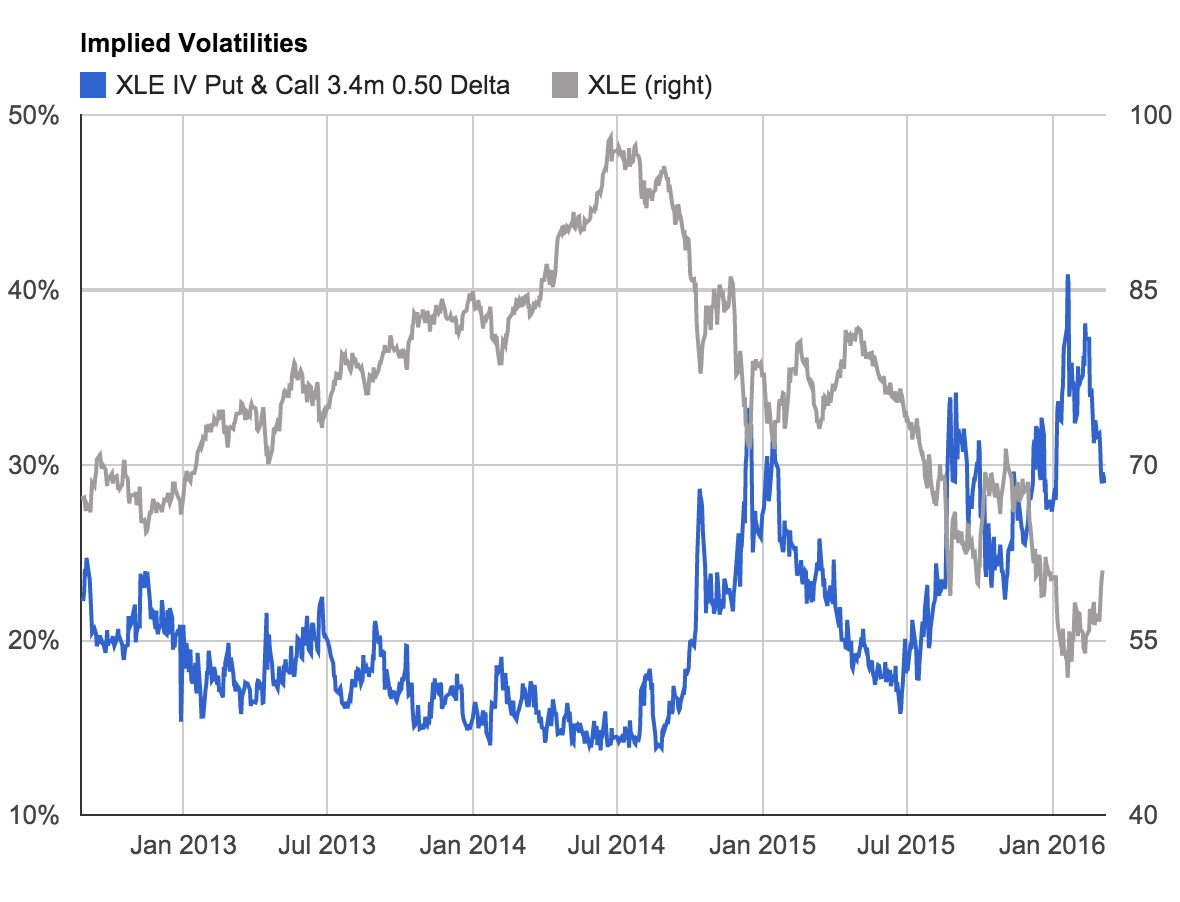

Revamped implied volatility charts

We have updated our implied volatility charts to overlay the price of the underlying market by default. We think this

makes it much more intuitive to contextualize current implied volatility levels with historical pricing.

Interested in private beta access? Sign up here.

Tags: updates • beta • correlation

23 Feb 2016

We are happy to announce two highly requested features today: 1) Put/Call Writing Screens

for weekly options, and 2) the ability to backtest strategies containing both options and underlying shares

or futures.

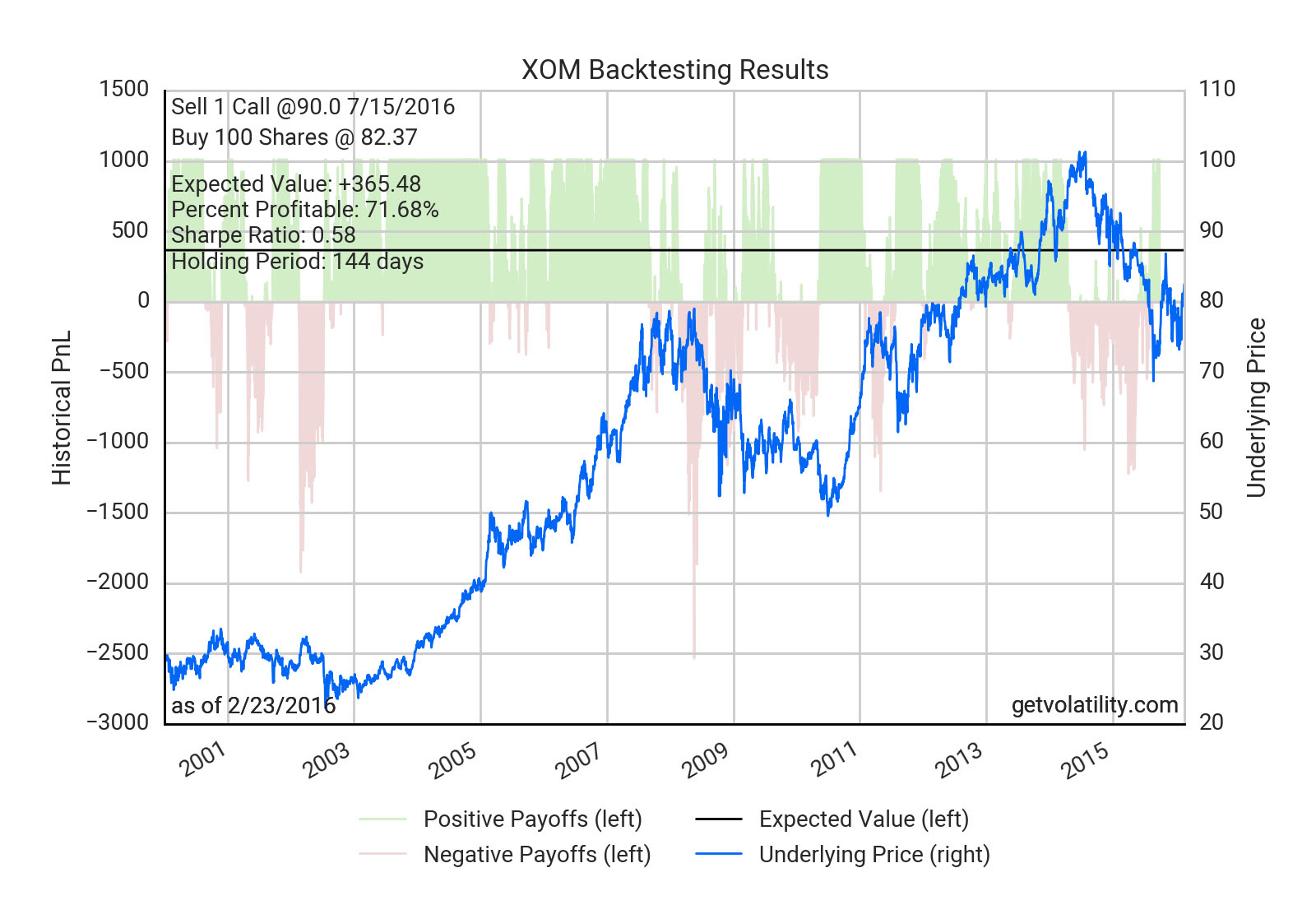

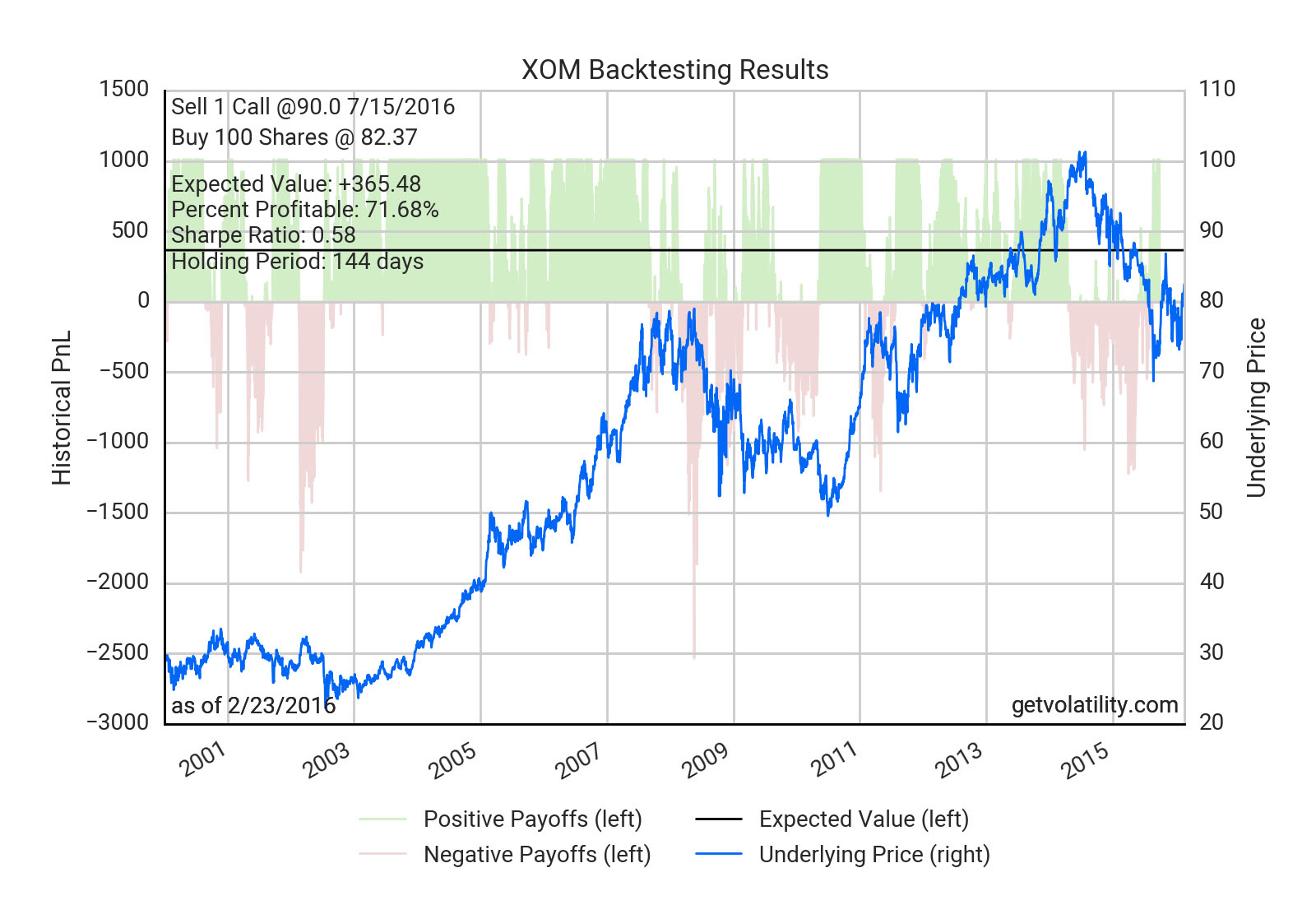

Backtesting

Many of the most popular options strategies are coupled with positions in the underlying market, and they are now

easier than ever to comprehensively backtest with Volatility. For example, you can determine in seconds whether

selling calls against your equity holdings could add to your bottom line or if put protection is unusually cheap

on holdings that concern you.

Here’s an example backtest

of owning 100 shares of Exxon coupled with selling 10% OTM call options. All of our core

backtesting functionality including early exit dates, IV range restrictions, and systematic calculation methods

have been updated to incorporate positions in the underlying market. Scenario Analysis and Payoff Diagrams have

also been updated.

Weekly Options Screens

Our screens are one of our most popular features, and we are excited to

now include weekly options opportunities. Select the “1w” choice in the tenor dropdown to view them.

Hint: For those of you that only want to see the shortest term opportunities in the Put/Call Writing Screens,

a handy trick is to sort by Days to Expiration ascending then sort by backtested Expected Value or Return on

Capital descending (shift click column headers to sort by multiple columns at the same time).

Interested in private beta access? Sign up here.

Tags: updates • beta • options backtesting • options screens • covered calls

09 Feb 2016

At popular request, we’ve put together another earnings guide this week. The table below summarizes

options market expectations and average historical earnings price moves for 12 major companies reporting this week.

A couple things caught our eye:

- Blizzard options price in an earnings move that’s more than 2x the historical realized average

- Baidu is the only name where options are pricing in a move less than the historical average

Tags: options market analysis • earnings