Valeant puts struck at 2.50

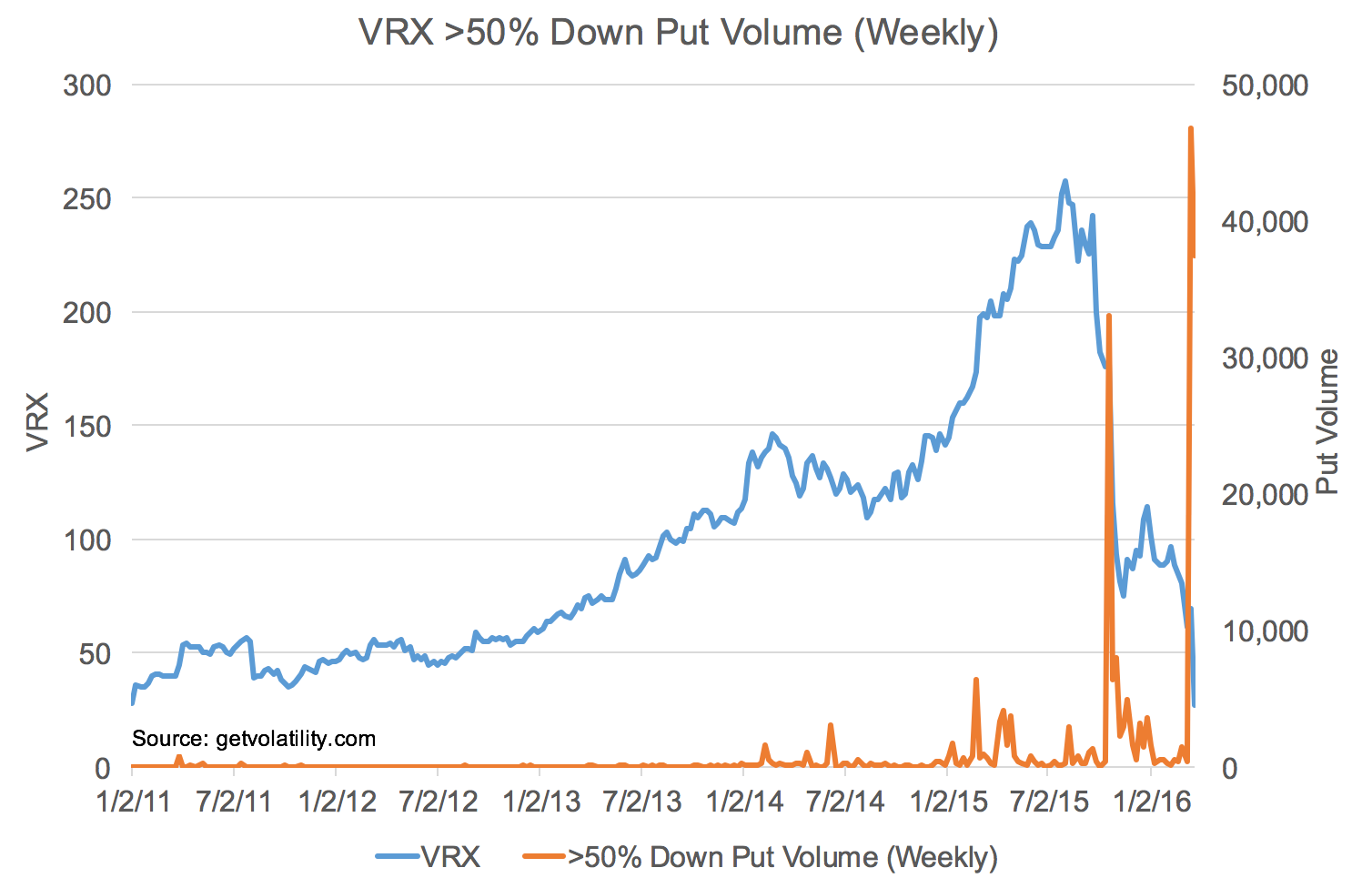

29 Mar 2016Puts struck at the scary level of 2.50 started trading on Valeant in the last several days, and they’ve already accumulated an open interest of 5,000 contracts. Options traders are positioning for a large decline more than ever before with puts struck >50% down trading in record size, breaking October’s activity (chart below). The majority of the today’s bearish volume is centered on 7.50 and 10.00 puts expiring in April and May, which are pricing in a roughly 12% chance of 10.00 by expiry. They would have a ~3x return in a repeat of the September through November 70% decline.