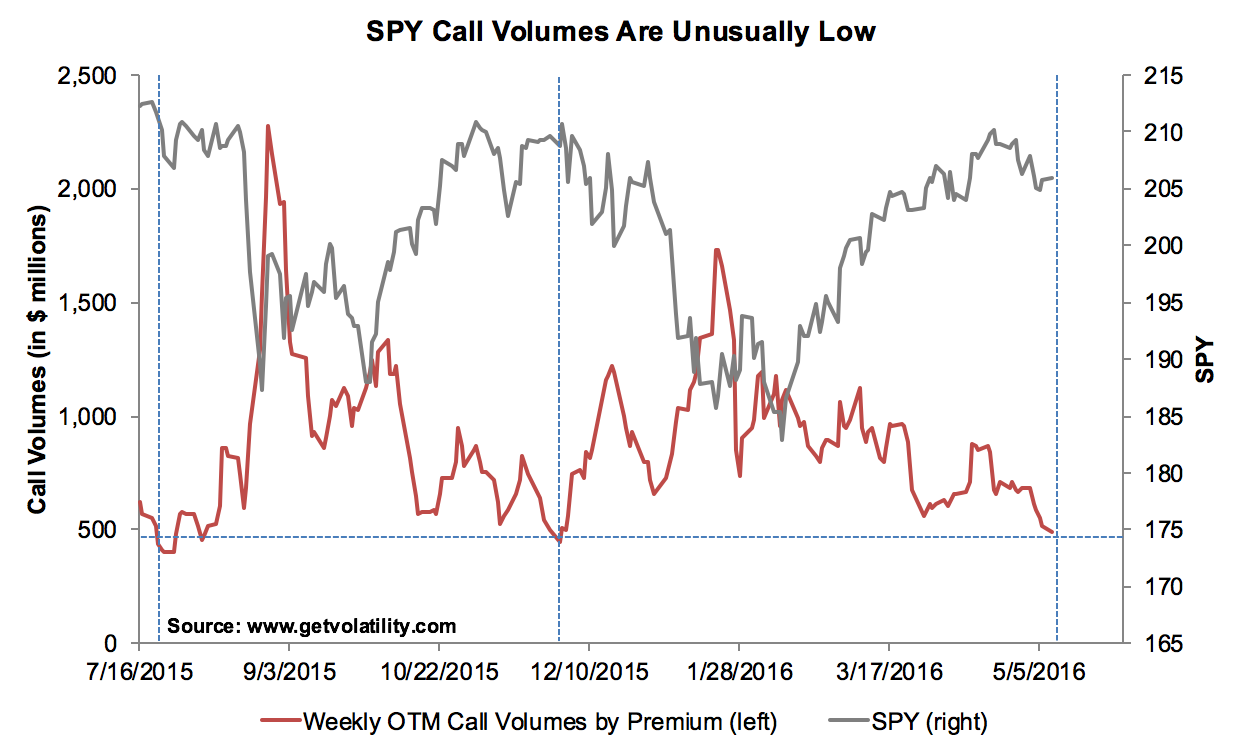

Upside call buyers disappear

10 May 2016As the S&P 500 stagnates in the 2,040 to 2,100 range, bullish index option volumes have dropped to the same low levels that occurred just before the 10% market declines in February and August (chart below). Interestingly, the lack of upside buying has not coincided with increased buying of put protection, indicating that many may be sitting on the sidelines instead of putting capital to work. With at-the-money volatilities low and skews high, hedgers can find attractively priced put spreads and longs can find well-priced call spreads.

Today’s attractive put-writes and covered calls

3m 10% OTM by historical success probability and backtested expected value. Click the stock to view backtesting results.

Put-writes: Allergan (85.3%; 2.6%), Viacom (85.0%; 2.3%), Gilead (87.8%; 2.0%).

Covered calls: Twitter (87.7%; 4.9%), Alibaba (83.5%; 1.0%), Aloca (85.0%; 1.0%).