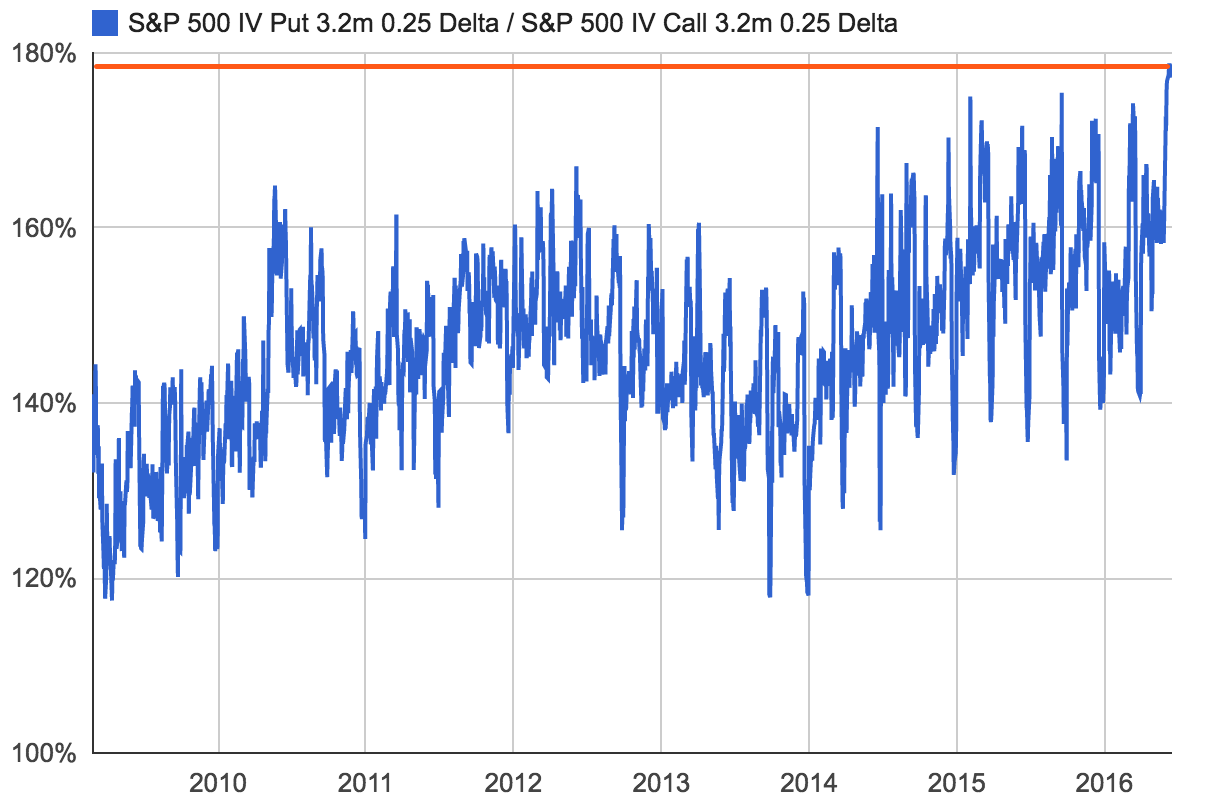

Put vs. call options skew is at the highest level in seven years

14 Jun 2016As the Fed meeting kicks off and we lead up to the Brexit vote, put protection is trading at the most expensive levels relative to upside calls over the past seven years (chart below). But with put option transaction volumes healthily below their median levels, the upcoming news events haven’t led to a notable surge in investors looking to hedge equities. With many staying on the sidelines, today’s options pricing presents opportunities with attractive backtesting results depending on your directional view:

Longs: Consumer Discretionary (XLY) Risk Reversals

Put writers: Biotech (XBI), Nike (NKE)

Covered call writers: Twitter (TWTR), Viacom (VIAB)

Hedgers: S&P 500 Put Spreads