Introducing weekly options screens and broader backtesting

23 Feb 2016We are happy to announce two highly requested features today: 1) Put/Call Writing Screens for weekly options, and 2) the ability to backtest strategies containing both options and underlying shares or futures.

Backtesting

Many of the most popular options strategies are coupled with positions in the underlying market, and they are now easier than ever to comprehensively backtest with Volatility. For example, you can determine in seconds whether selling calls against your equity holdings could add to your bottom line or if put protection is unusually cheap on holdings that concern you.

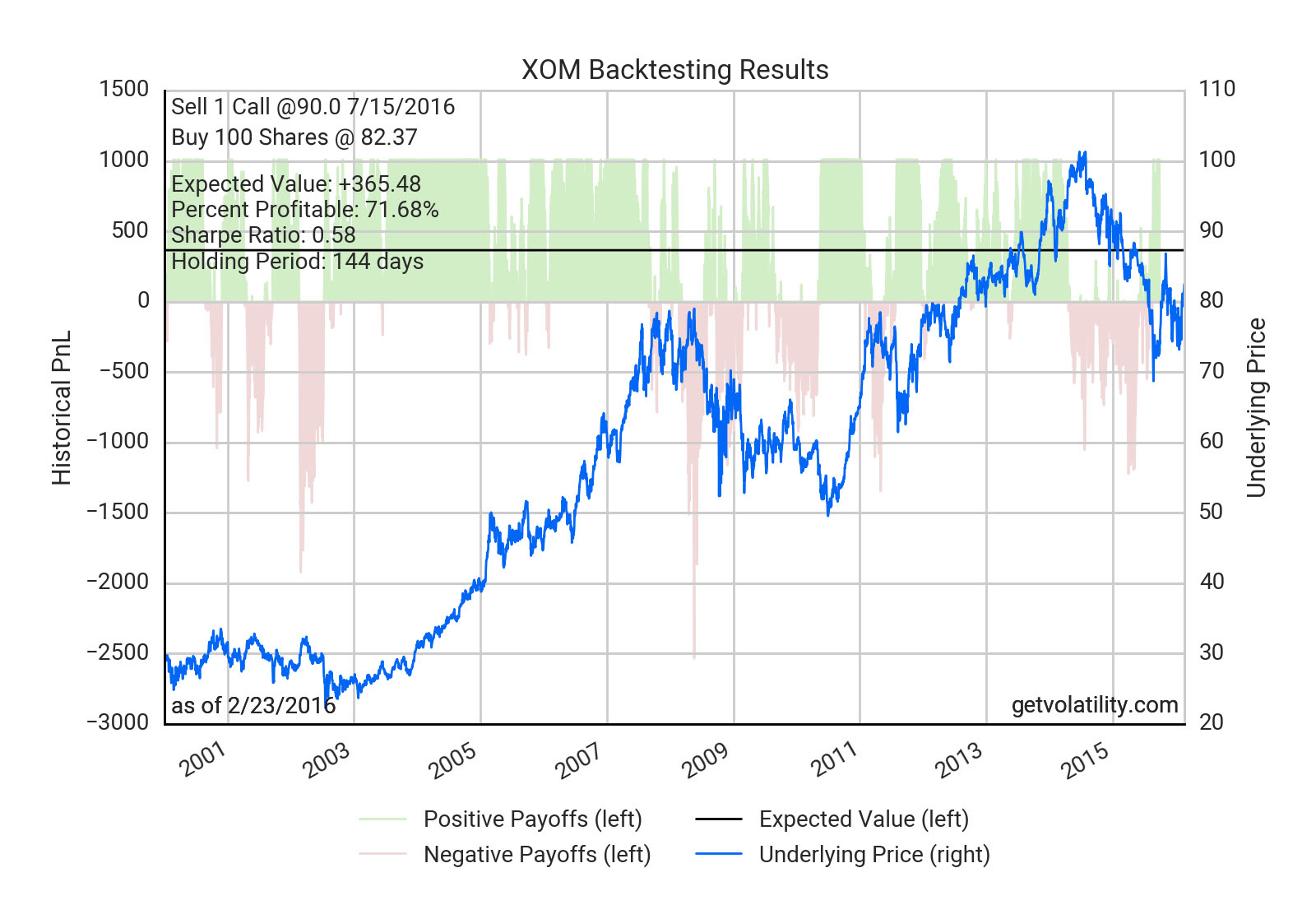

Here’s an example backtest of owning 100 shares of Exxon coupled with selling 10% OTM call options. All of our core backtesting functionality including early exit dates, IV range restrictions, and systematic calculation methods have been updated to incorporate positions in the underlying market. Scenario Analysis and Payoff Diagrams have also been updated.

Weekly Options Screens

Our screens are one of our most popular features, and we are excited to now include weekly options opportunities. Select the “1w” choice in the tenor dropdown to view them.

Hint: For those of you that only want to see the shortest term opportunities in the Put/Call Writing Screens, a handy trick is to sort by Days to Expiration ascending then sort by backtested Expected Value or Return on Capital descending (shift click column headers to sort by multiple columns at the same time).

Interested in private beta access? Sign up here.