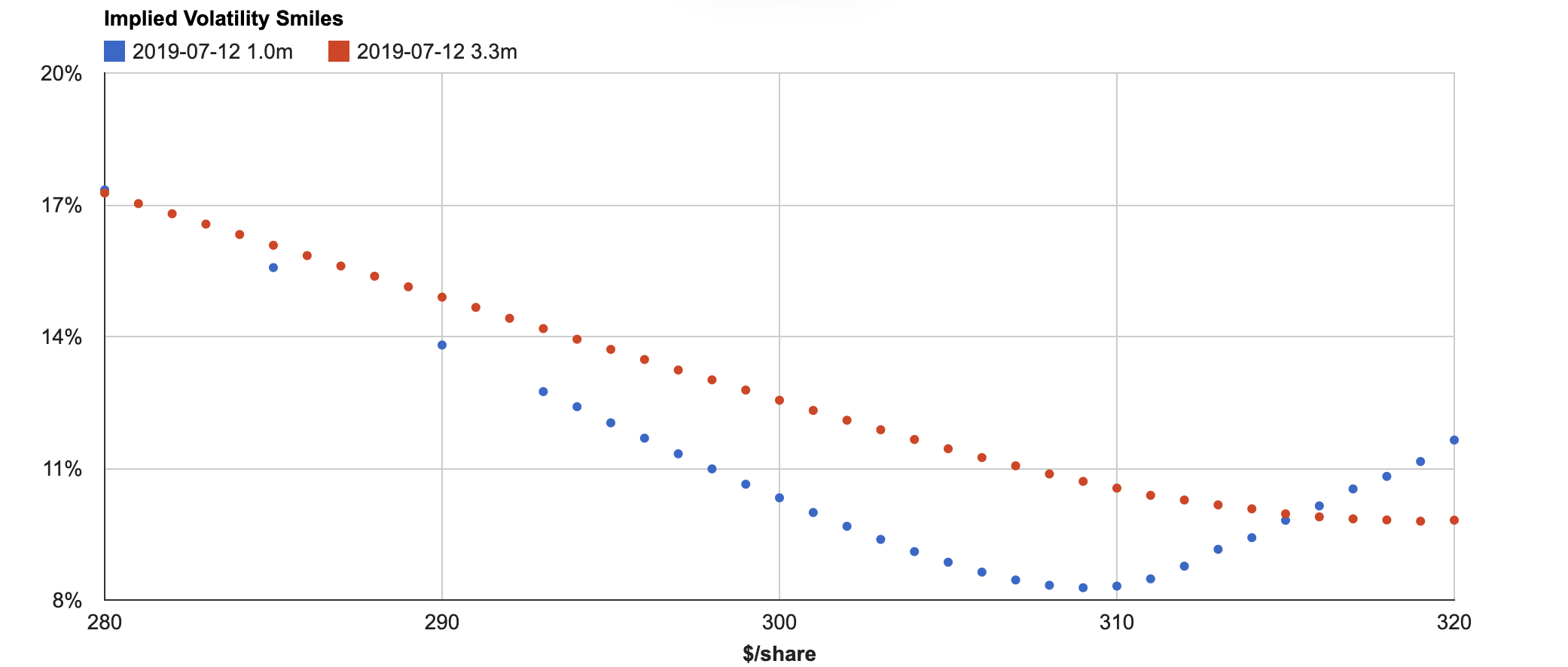

Volatility Skew Charting

The Volatility Skew (also called "Smile") chart displays implied volatilities by strike price for different maturity dates. The smile shape that usually occurs in this data results from higher implied volatilities being priced into out-of-the-money options due to the asset’s gap risk. This chart can help you pinpoint which strike and maturity to trade by identifying areas of low or high implied volatility depending on your strategy.

You can modify this chart to plot different maturities on historical dates by clicking the “Edit chart” button.