Options Price Conditions

Price conditions allow you to backtest precise rules regarding price thresholds where you may buy or sell options. For example, you may only want to sell options when their premium is expensive and above a certain value or purchase options when premiums are cheap and below a certain value. These conditions allow you to backtest those threshold values and optimize them to maximize return and minimize risk.

Net Premium

Net premium is defined as the total debit (positive value) or credit (negative value) of all of the options in your strategy on a per share basis. As an example, if you're selling a put spread which includes a sold option with a premium of $5 and a bought option with a premium of $1, the net premium will be -$4. If you were purchasing that put spread, the net premium would be positive $4.

Dollar Premium Conditions

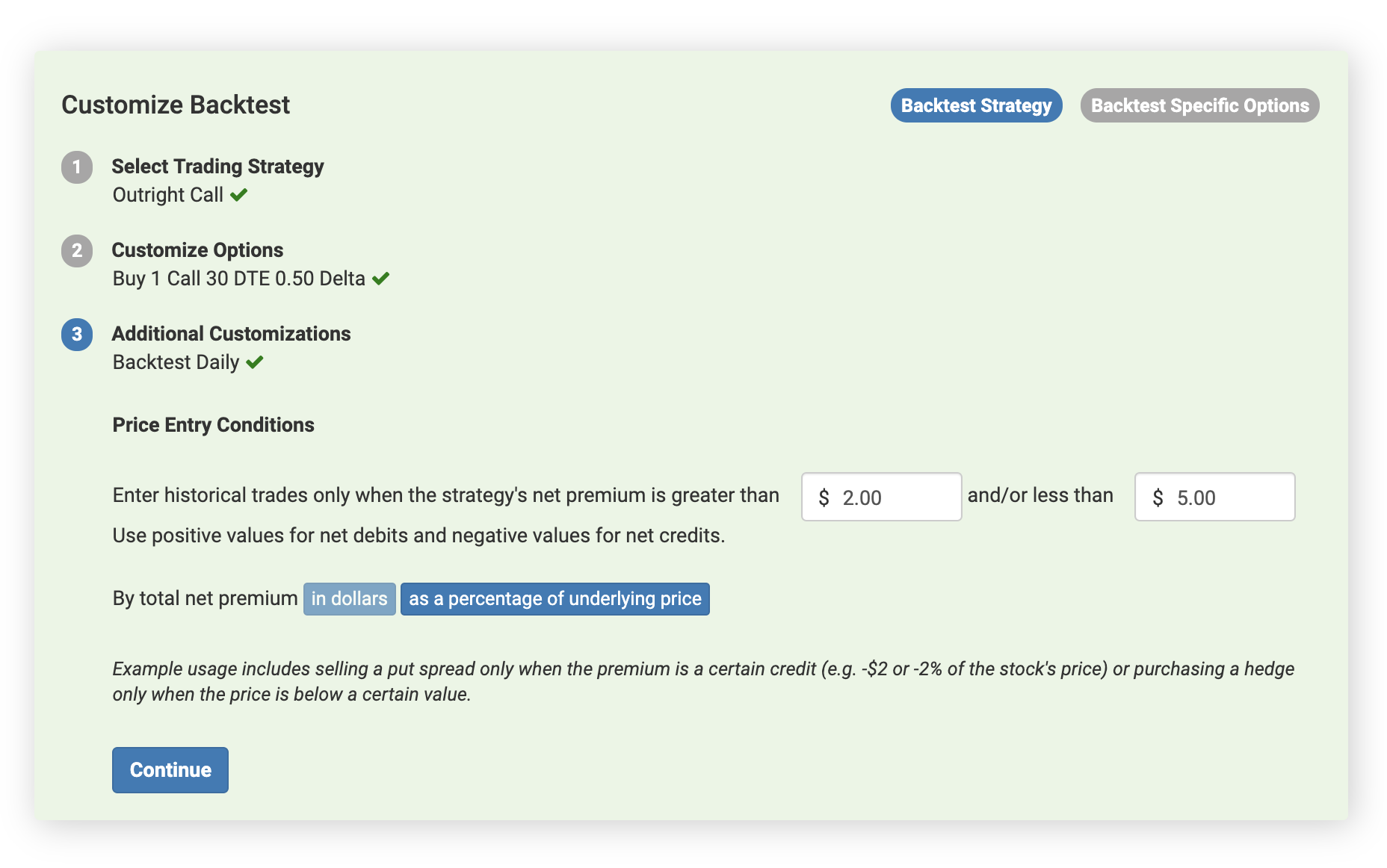

To only enter your strategy when the net premium in dollars is greater than a certain value, enter the value in the first input box as per the screenshot below. You can also set an upper bound on this condition by entering a value in the second input box. For example, entering "2" and "5" in the input boxes in the screenshot below would result in a backtest where the strategy is only traded when the net premium is greater than $2.00 and less than $5.00. Entering only "5" in the second box would result in trading the strategy whenever the premium is less than $5.00. Entering only "2" in the first box would result in trading the strategy whenever the premium is greater than $2.00.

Percentage Conditions

If you'd like to enter the price conditions as a percentage of the underlying price rather than absolute dollar amounts, select "By total net premium as a percentage of underlying price". For example, you can use this setting to only backtest purchasing 30-day at-the-money calls on Apple Inc. when their premium is less than 2% of the stock's price.

Exit Conditions

Price conditions can be used to determine both entry and exit points for your options strategy. For example, you can set conditions such that you purchase your strategy whenever the price is below $1 and sell it whenever the price rises above $2.