Unusual Options Activity

Trades that are unusually large in volume can indicate that a trader has very high confidence in a particular outcome and is using the significant leverage embedded in options to maximize their P&L when that event occurs. Identifying these trades can help you understand what traders with large resources are expecting to happen and how they are using options to their advantage.

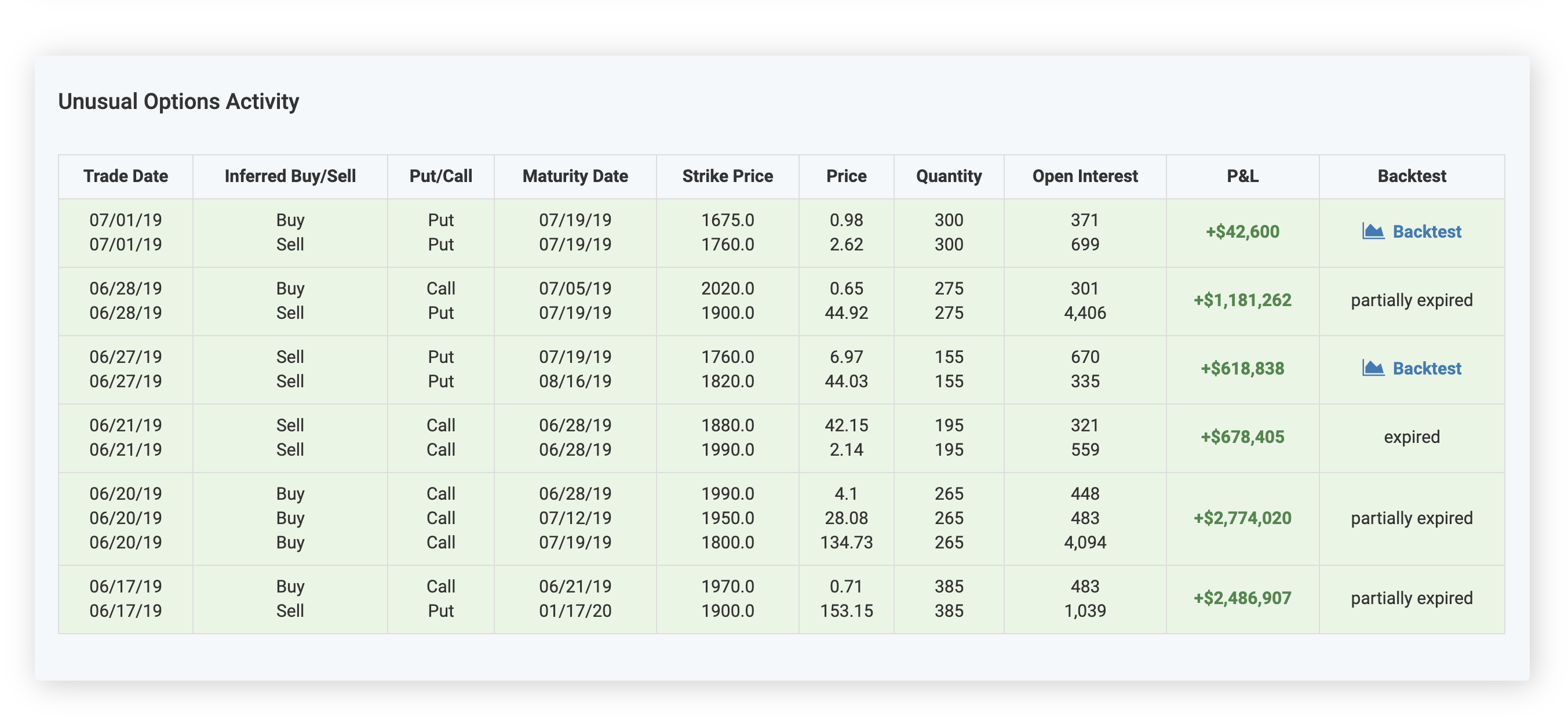

The Unusual Options Activity screen shows these unusually large trades in an easy-to-use table. The date that each position was established, the inferred direction of the trade, option parameters, quantity, open interest, and P&L are shown. A link that will immediately backtest the particular position is also included for each trade in the screen. Trade directions are inferred based off whether the trades occur closer to the ask price (suggestive of a purchase) or the bid price (suggestive of a sale).