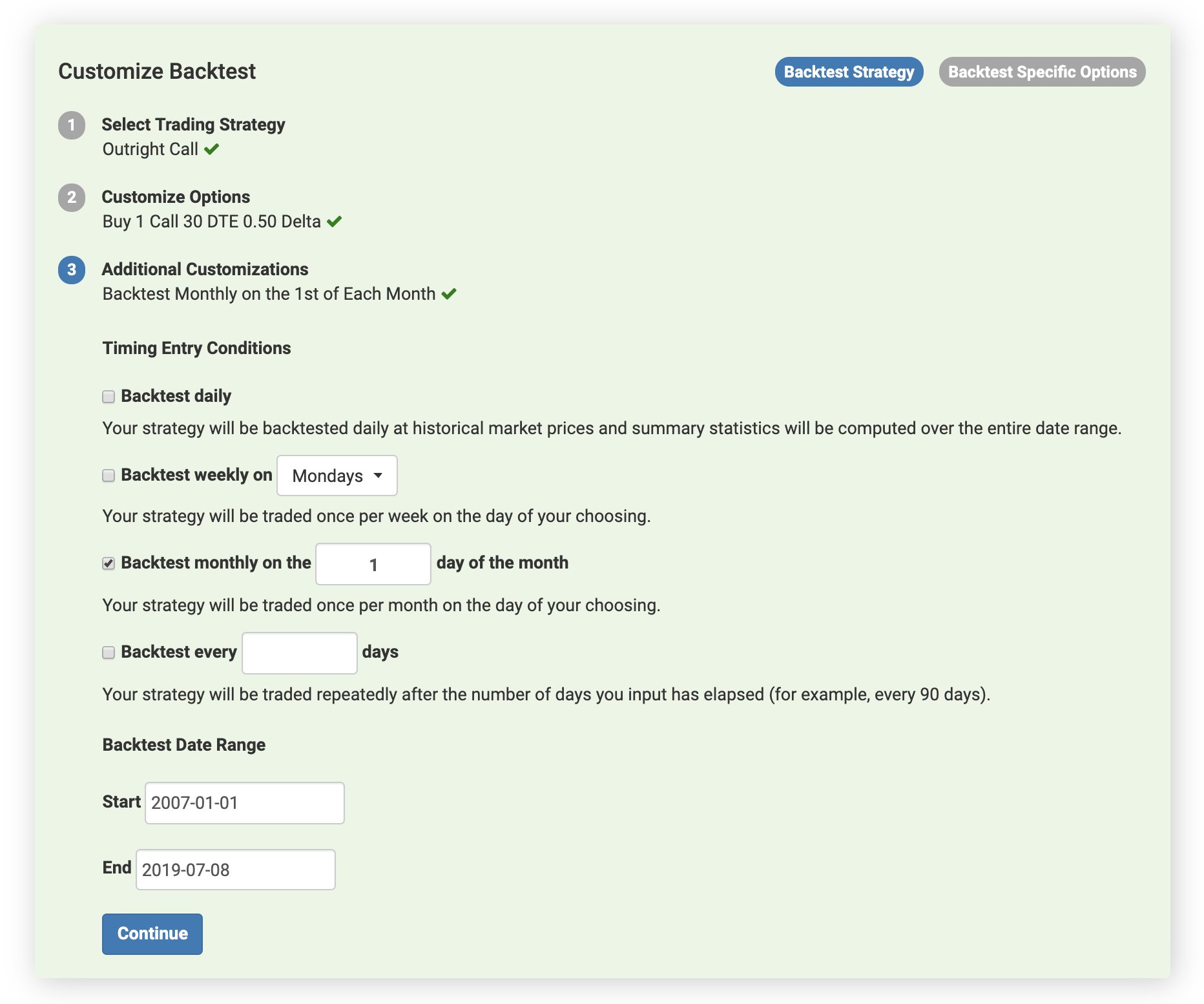

Timing and Date Range

As mentioned in Starting Your Backtest, the Volatility Backtester backtests your strategies daily by default in order to increase sample size and the statistical significance of the results. However, oftentimes a trader will have a strategy that they only execute at set times, for example monthly or weekly. Timing conditions allow you to flexibly set these types of rules in your backtest.

Daily

This is the default setting, and your strategy will be backtested with trades initiated on every historical trading day.

Weekly

Select a day of the week to program the Backtester to only trade your strategy on that particular day. For example, selecting Wednesday will result in your strategy being backtested only on Wednesdays.

Monthly

Input a day of the month to program the Backtester to only trade your strategy on that particular day of each month. For example, entering "1" will result in your strategy being backtested only on the 1st of each month. Please note that if the date inputted is not an available trading day (e.g., because it is a Saturday, Sunday, or holiday), the Backtester will use the closest available trading day for that particular month.

Periodically

Input the number of days between each trade in your strategy. For example, entering "45" will result in the Backtester trading your strategy historically every 45 days.

Backtest Date Range

You can customize the Start Date and End Date for the backtest in the Backtest Date Range section. By default, the Backtester will include all historical data that is available for the backtest. However, if you only wanted to backtest over the last five years, for example, you could modify the Start Date. Free trial backtests are limited to the past three years of history. Subscriber backtests contain all available historical dates.