Starting Your Backtest

The Volatility Backtester allows you to backtest and view the historical profitability of any options strategy in seconds. Follow this guide to set up your options backtest.

Launch the Backtester

Begin by navigating to the Backtester for the stock or futures market that you want to analyze. Often the fastest way to do this is through the Start Bar on the top of every page within the platform. Here is a direct link to load the S&P 500 ETF (SPY) Backtester.

Define Your Strategy

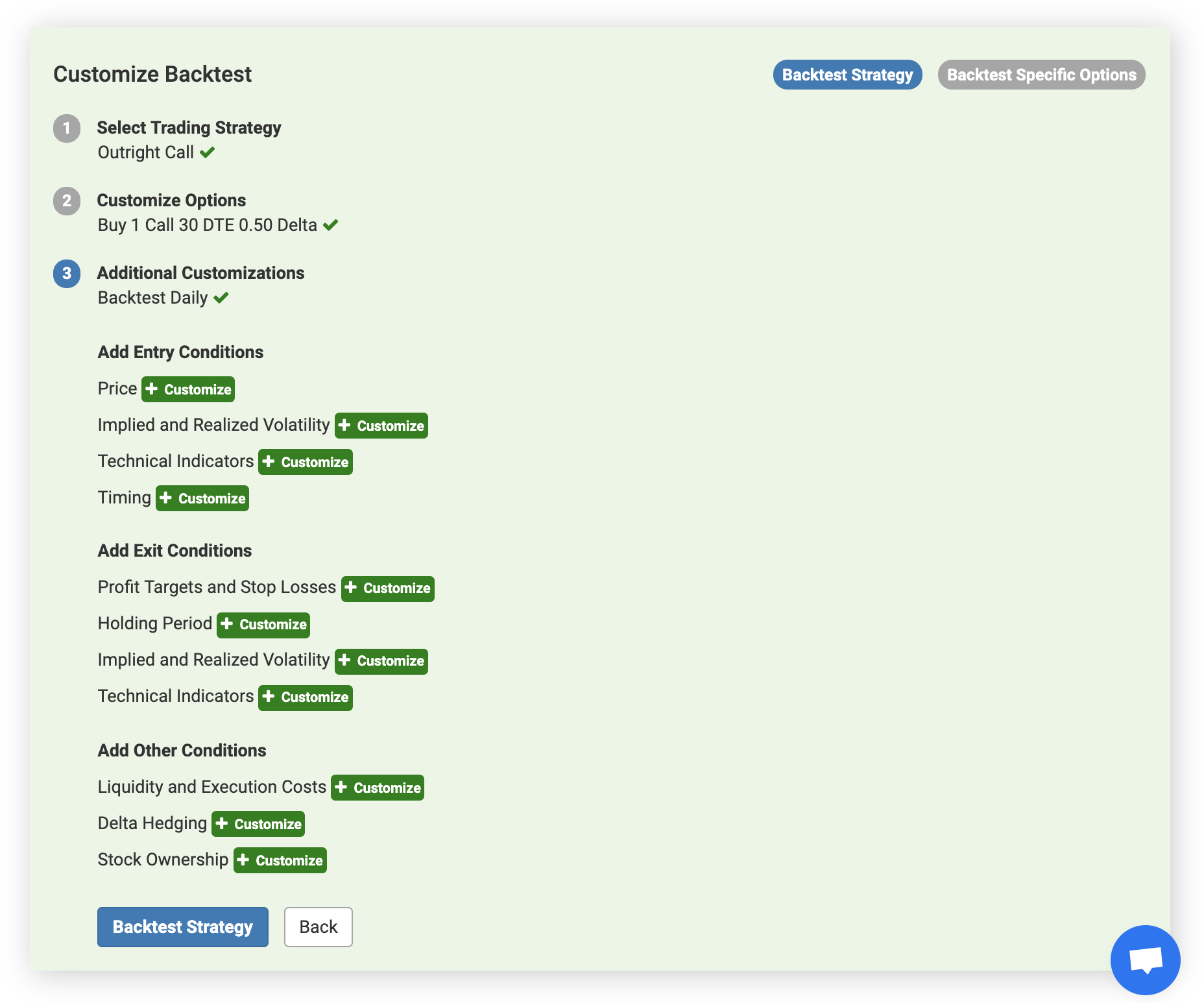

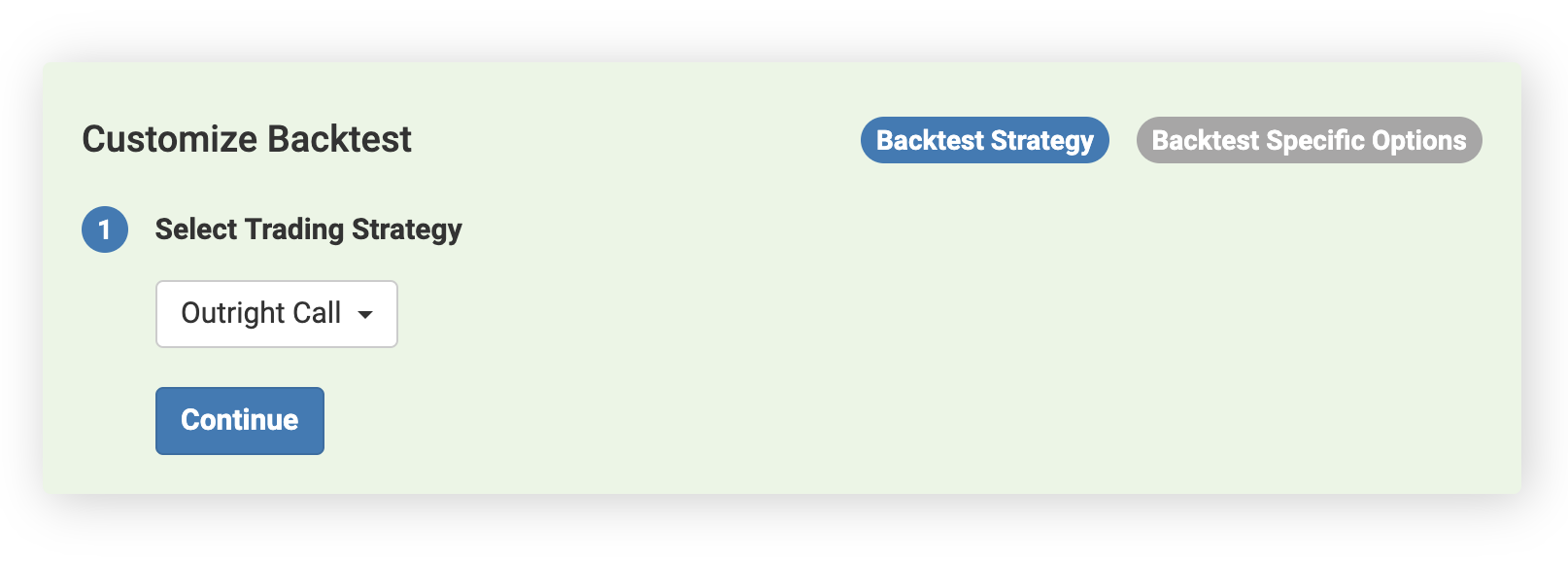

Set the initial parameters for the strategy you want to backtest by following the steps in the green Customize Backtest box at the top of the Backtester.

- Select the type of options strategy that you want to backtest using the dropdown menu. Available strategies include Outright Call, Outright Put, Covered Call, Call Spread, Put Spread, Straddle, Strangle, Iron Condor, Butterfly, and Risk Reversal. If your strategy is not included in that list, you can select Custom to build your strategy with any combination of option legs.

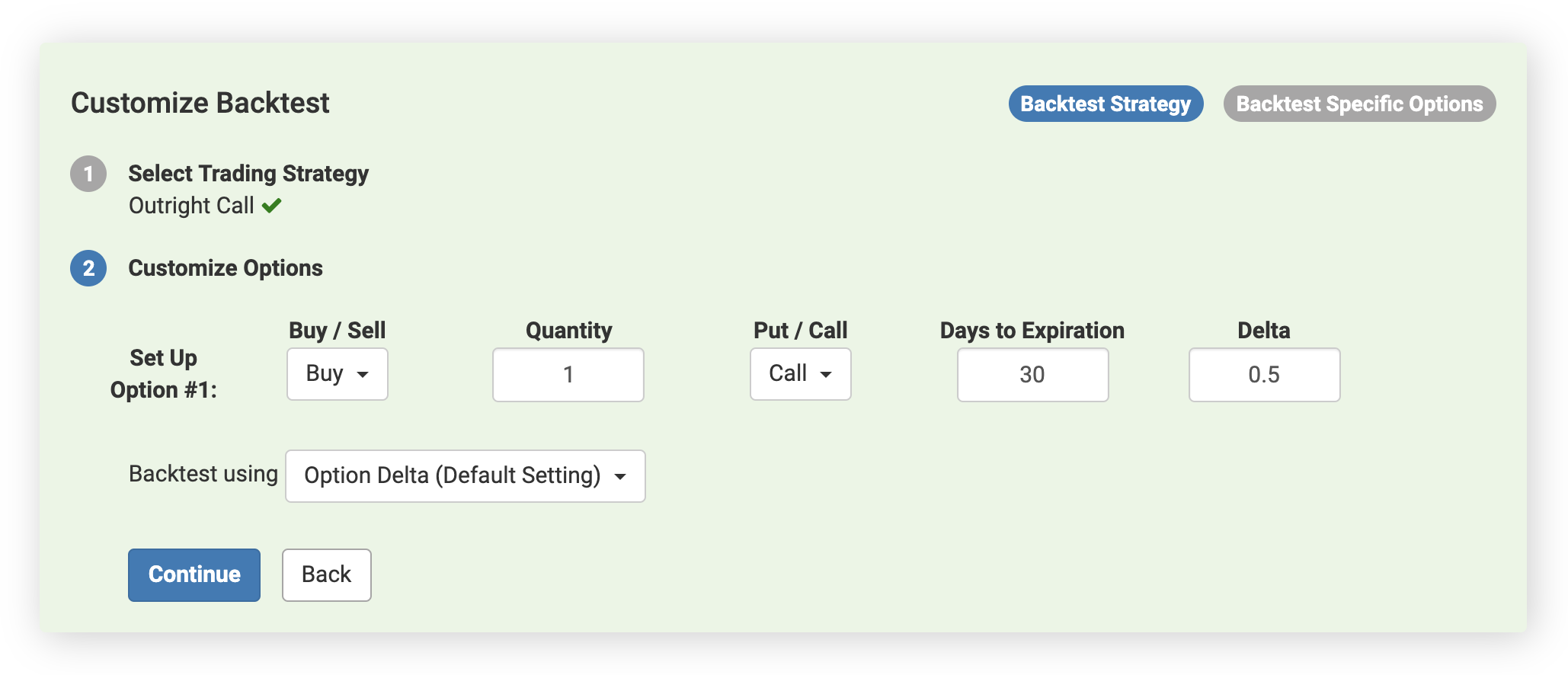

Customize the options in your strategy by setting the buy or sell direction, the quantities (number of contracts), put or call option type, days to expiration, and delta values for each option leg in your strategy.

If you would prefer to define your option legs using option moneyness instead of option delta, select "Backtest using Option Moneyness". For moneyness, 100% represents an at-the-money option, 95% would represent a strike 5% below the underlying's price, and 105% would represent a strike 5% above the underlying's price.

In this example, we are backtesting purchasing 1 call option on the S&P 500 ETF (SPY) that expires in 30 days and has 0.50 delta. Delta values are entered in decimals.

If you have selected a strategy with multiple option legs, you can modify these parameters for each leg. For example, for a call spread, you will have a bought call and a sold call. If you have selected a Custom strategy, you can add or remove multiple option legs to the backtest to fit your requirements by clicking the "Add Option" and "Remove Option" buttons.

You can set additional customizations for your options strategy such as entry and exit conditions to further optimize your backtest. These customizations are optional, and we will walk you through each of them next in this guide.

There are roughly 50 entry and exit conditions that you can choose from such as options price conditions, implied and realized volatility conditions, technical indicators, and more. By default, the only condition added is daily backtesting. The Volatility Backtester will trade your strategy daily over more than a decade of historical data to increase the statistical significance of the backtesting results using a larger trade count and sample size. As we will see in the next sections, you can also modify this setting to fit your strategy.

To run your backtest and view results, click Backtest Strategy.