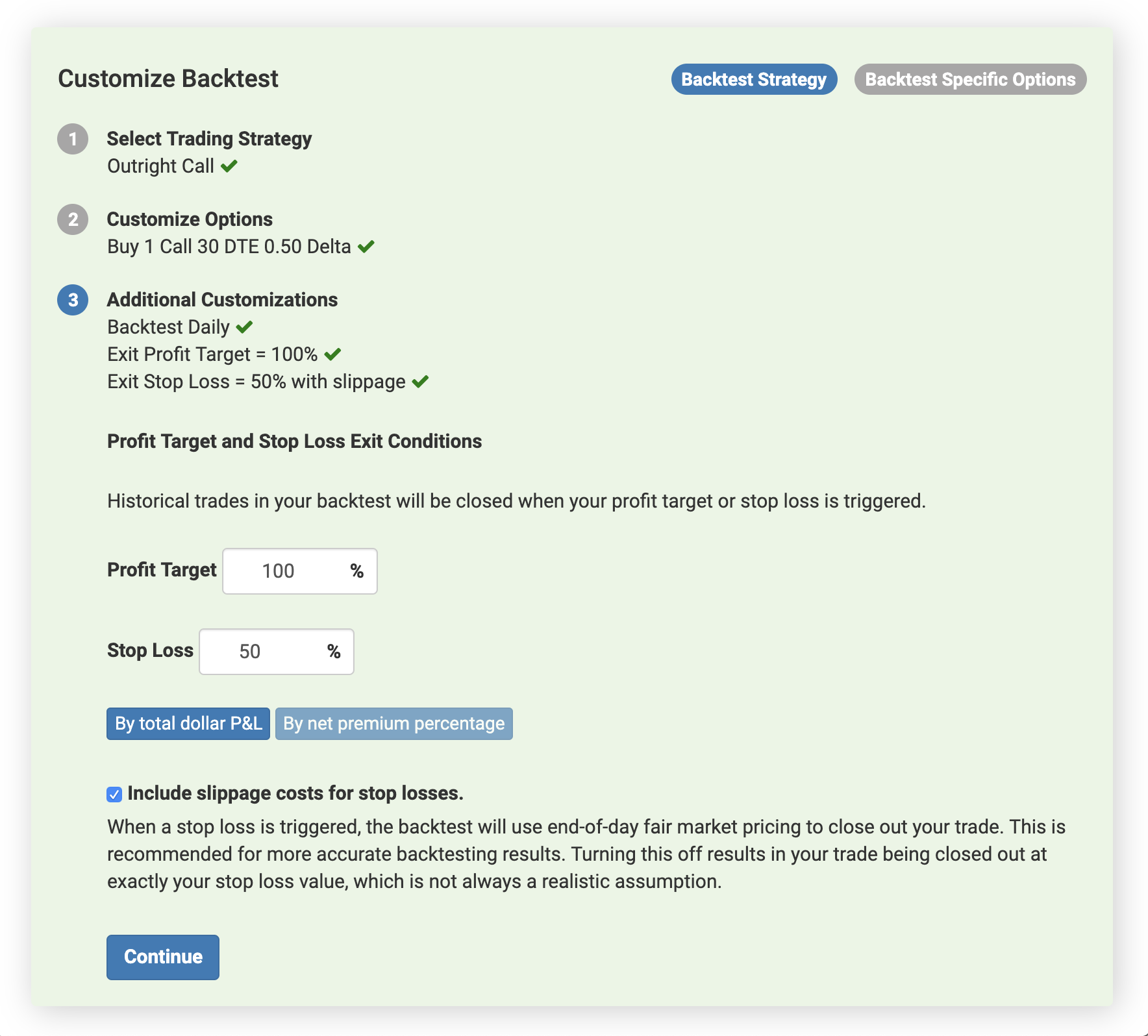

Profit Targets and Stop Losses

A common practice among traders is to exit positions after they make a certain amount of money, called a profit target, or to cut losses after they breach a certain level, called a stop loss. The Volatility Backtester allows you to easily analyze the historical efficacy of profit targets and stop losses for your options trading strategy. The quick results allow you to speedily optimize the profit targets and stop losses to the values that would have generated the best historical risk-adjusted returns.

By Dollar P&L

Profit targets and stop losses can be entered as absolute dollar amounts where the historical trade in the backtest will be closed if the inputted P&L values are reached.

By Percentage Return on Net Premium

Alternatively, you can set these values based off a percentage of the strategy's net premium. As the historical premium to enter your strategy can vary significantly with time, a percentage values sometimes makes more sense depending on your strategy. If the net premium of your strategy on a historical date is $2.00, and you set a profit target of 100% and a stop loss of 50%, the Backtester will exit this historical trade if the prevailing premium reaches $4.00 or breaches $1.00.

Slippage Costs

When exiting a position in the real world, slippage costs can be incurred. In the above example, the price of the strategy could immediately gap down from $2.00 to $0.50, and a stop loss modeled exit at $1.00 would therefore be unrealistic. The Volatility Backtester by default aims to incorporate these slippage costs by utilizing the end-of-day strategy price for your exit. As an example, if the gap down to $0.50 at market open recovered to $0.75 at market close, the Backtester would model a stopped exit at $0.75.

This setting can be disabled by unchecking the box corresponding to "Include slippage costs for stop losses".