Portfolio Backtesting

Volatility’s Portfolio tool allows you to backtest, optimize, and keep track of positions across multiple asset classes spanning any variety of trading strategies. Our Backtester provides you with unparalleled insight into the historical performance and risk of a single options strategy. Our Portfolio tool takes these analytics to the next level by allowing you to backtest multiple strategies encompassing numerous trades together all from one place. The Portfolio tool includes Backtesting Statistics, the Backtest Visualization, and Backtest Equity Curve as also seen in the Volatility Backtester.

Adding Strategies to Your Portfolio

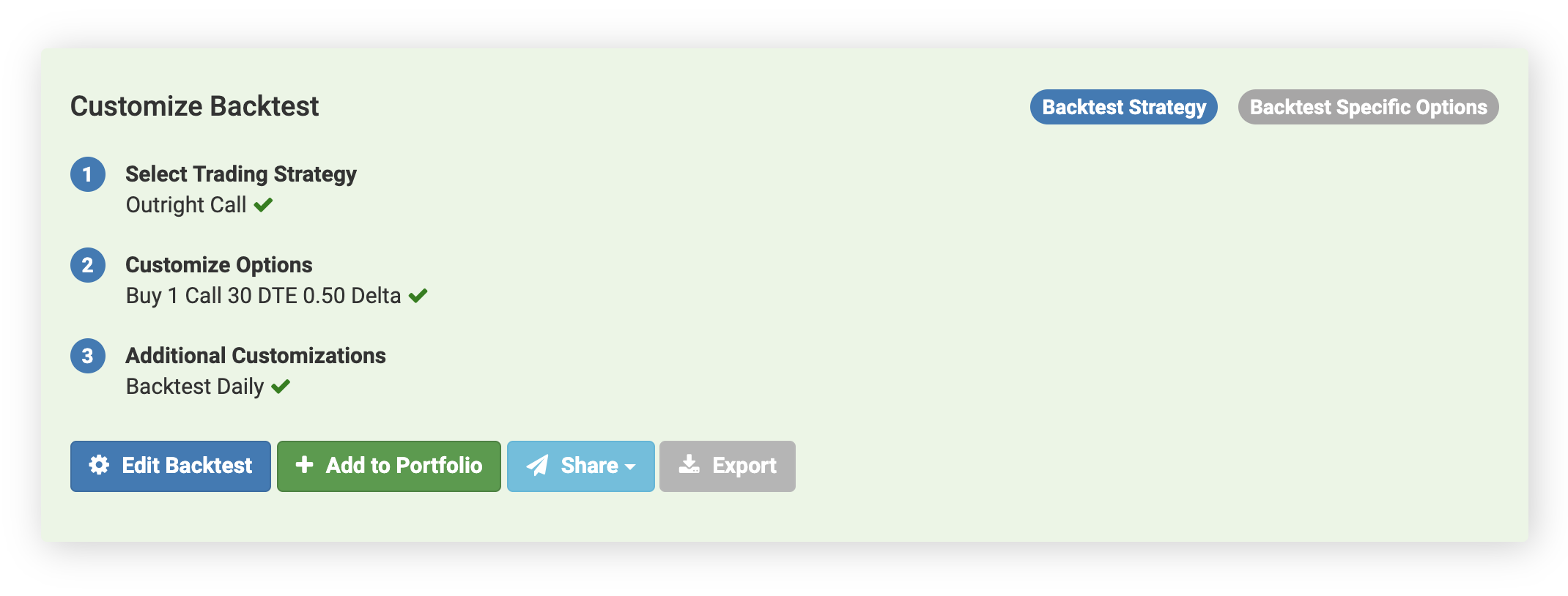

To add a trade to your Portfolio, simply click the "Add to Portfolio" button after a backtest completes. This trade will now live inside your Portfolio and will be backtested in conjunction with any other trades you also add. For example, you can add several covered call or put writing strategies to your Portfolio and see how their collective Sharpe ratios and drawdowns fare compared to on a trade-by-trade basis. You could also add in a hedge trade and see how that mitigates downside risk historically. The possibilities with this feature are truly infinite.

Removing Strategies from Your Portfolio

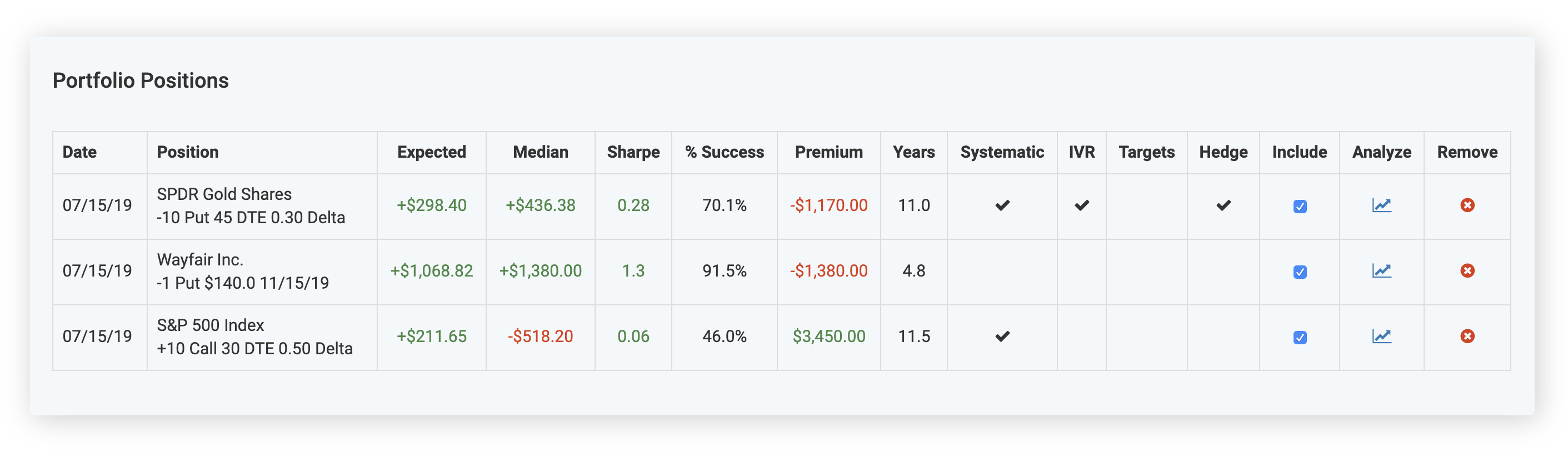

To remove a trade from your Portfolio, hover over the "Added to Portfolio" button within the backtesting results and click "Remove from Portfolio". You can also remove individual trades within your Portfolio itself by clicking on the red "X" buttons corresponding to their position line items in the Portfolio Positions table.

Excluding Positions from the Backtesting Results

By default, the Portfolio tool will backtest all of your positions together and provide you with summary results. You can change this to only include certain positions by clicking the "Include" checkboxes within the Portfolio Positions table underneath the backtesting charts. This feature is extremely useful for determining the impact of individual trades on your overall portfolio. For example, you can temporarily exclude a hedging trade and examine your portfolio’s collective drawdown risk and then add the hedge back to see how well the risk is mitigated.

The Volatility Portfolio Backtester will include all historical dates regardless of whether all positions were tradable on each date. You can choose to only include historical trade dates where all of your positions were available by clicking the checkbox at the bottom of the Portfolio tool (labeled "Only include historical dates where all of my positions were available concurrently"). Turning this feature on is particularly important for Portfolios where positions are meant to interact or counterbalance each other, for example as in relative value strategies where you are long one market and short another.

Saving Backtests

Another use case for the Portfolio tool is to save backtests that you want to access later. Clicking an "Analyze" link in the Portfolio Positions table will take you back to the detailed backtesting results for that individual position.