Pair with Underlying Shares

You can easily add Underlying Shares or Futures Contracts to your backtest. This allows for backtesting of options strategies that work alongside a position in the underlying market such as covered calls and collars.

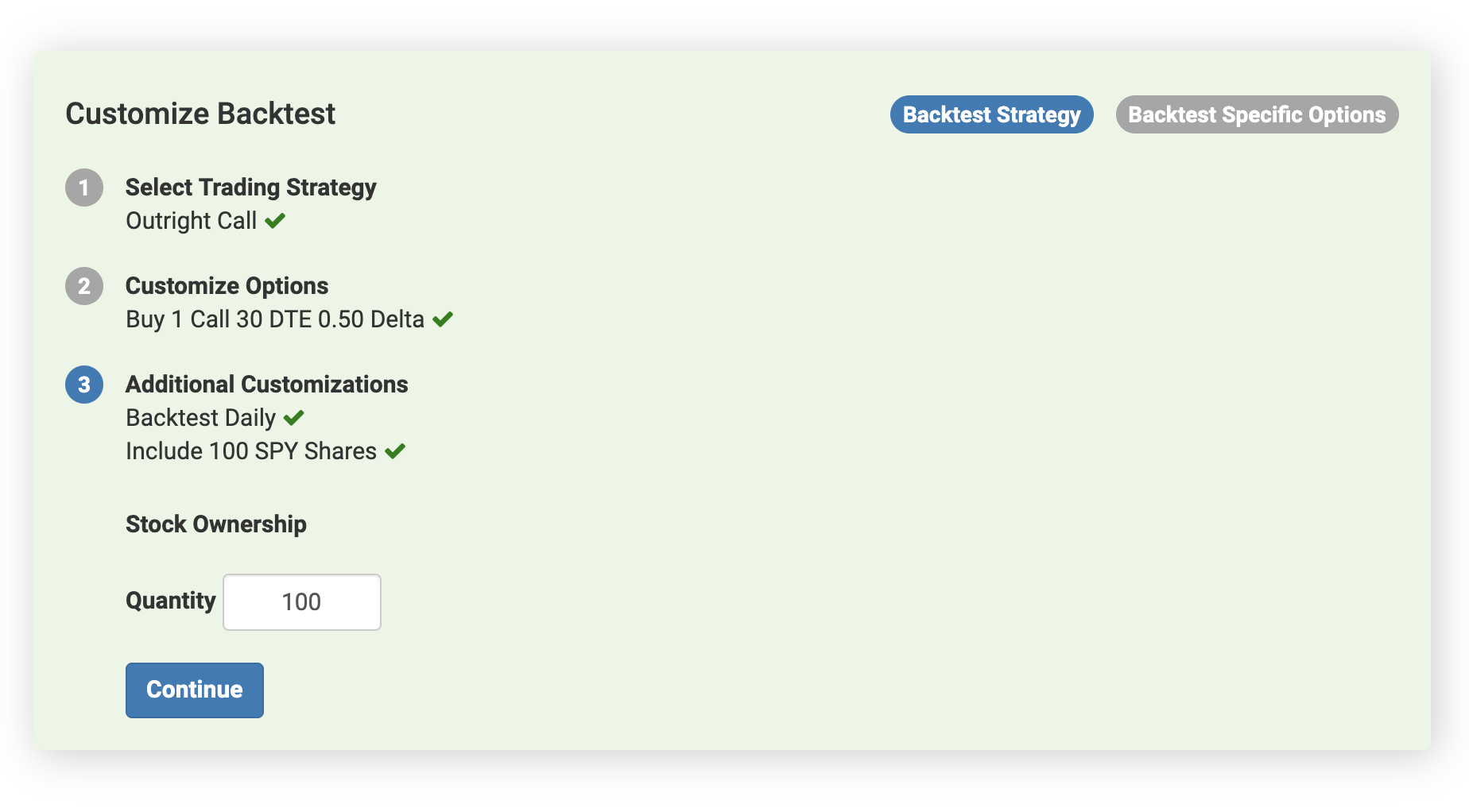

To add an underlying position, click Customize "Stock Ownership" or "Futures Contracts" within the Additional Customizations and Add Other Conditions sections. In the input box as per the screenshot below, enter the number of shares or contracts to include in the backtest. Use positive values for long positions and negative values for short positions.

With underlying positions in your backtest, Volatility will calculate the historical P&L of your options strategy in addition to the P&L of the underlying position you've inputted.