Opportunities Search

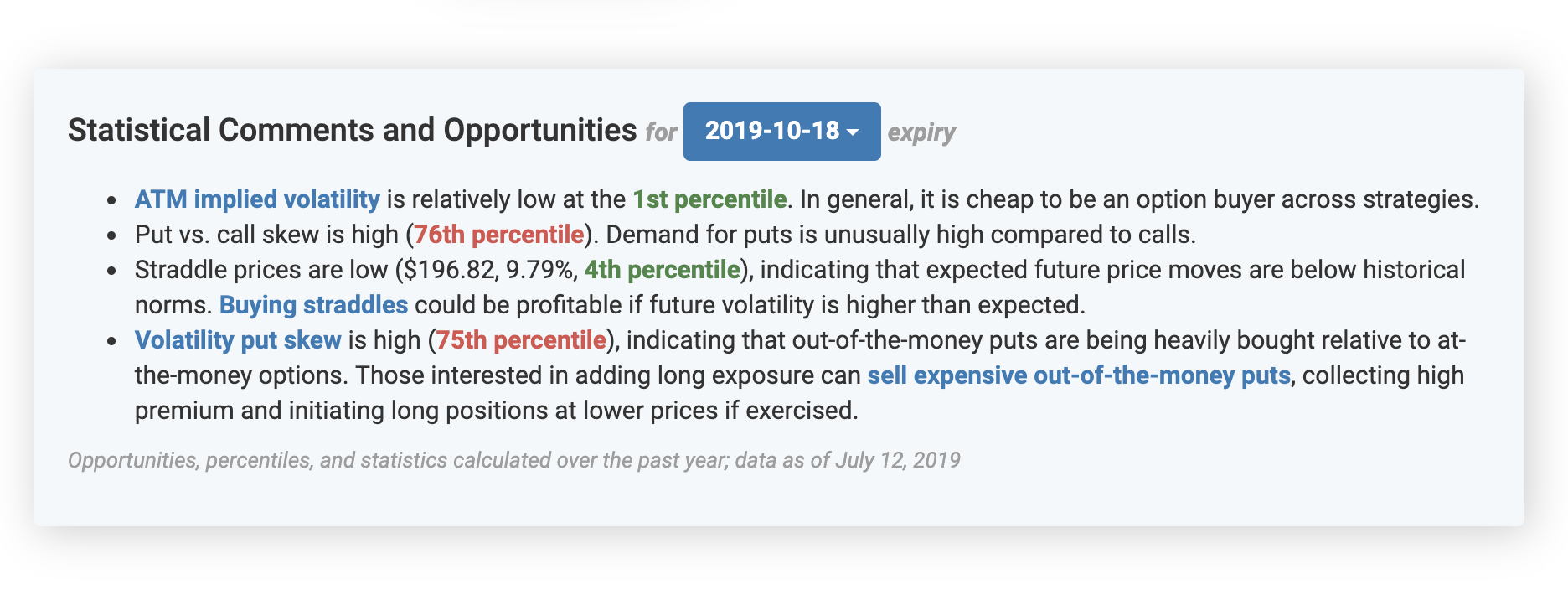

Volatility automatically backtests hundreds of thousands of options strategies every day and uses sophisticated algorithms to highlight opportunities that are particularly attractive for you. You can view these Statistical Opportunities on each market’s Opportunities page (Example: S&P 500 Opportunities).

Most identified opportunities include a link to further analysis on the platform. For example, if implied volatility is unusually low on a stock trading at expensive levels, Volatility may highlight put options as attractive hedging trades and link you directly to their backtesting results.

Statistical opportunities are calculated using a broad range of data types, and most opportunities are calculated using the last year of historical data. By default, Volatility will show you opportunities for options expiring in three months. You can change this to other option expiries that interest you by using the expiry dropdown menu.