Holding Periods

Traders will often close an options position before the options expire. Options generally decay in value faster the closer you get to expiration, and option buyers can save money by closing these positions before that decay is fully realized. Option sellers on the other hand, may want to unwind their position early in order to reduce the risk of a large underlying price gap near expiration suddenly removing the gains that they have realized over long periods of time.

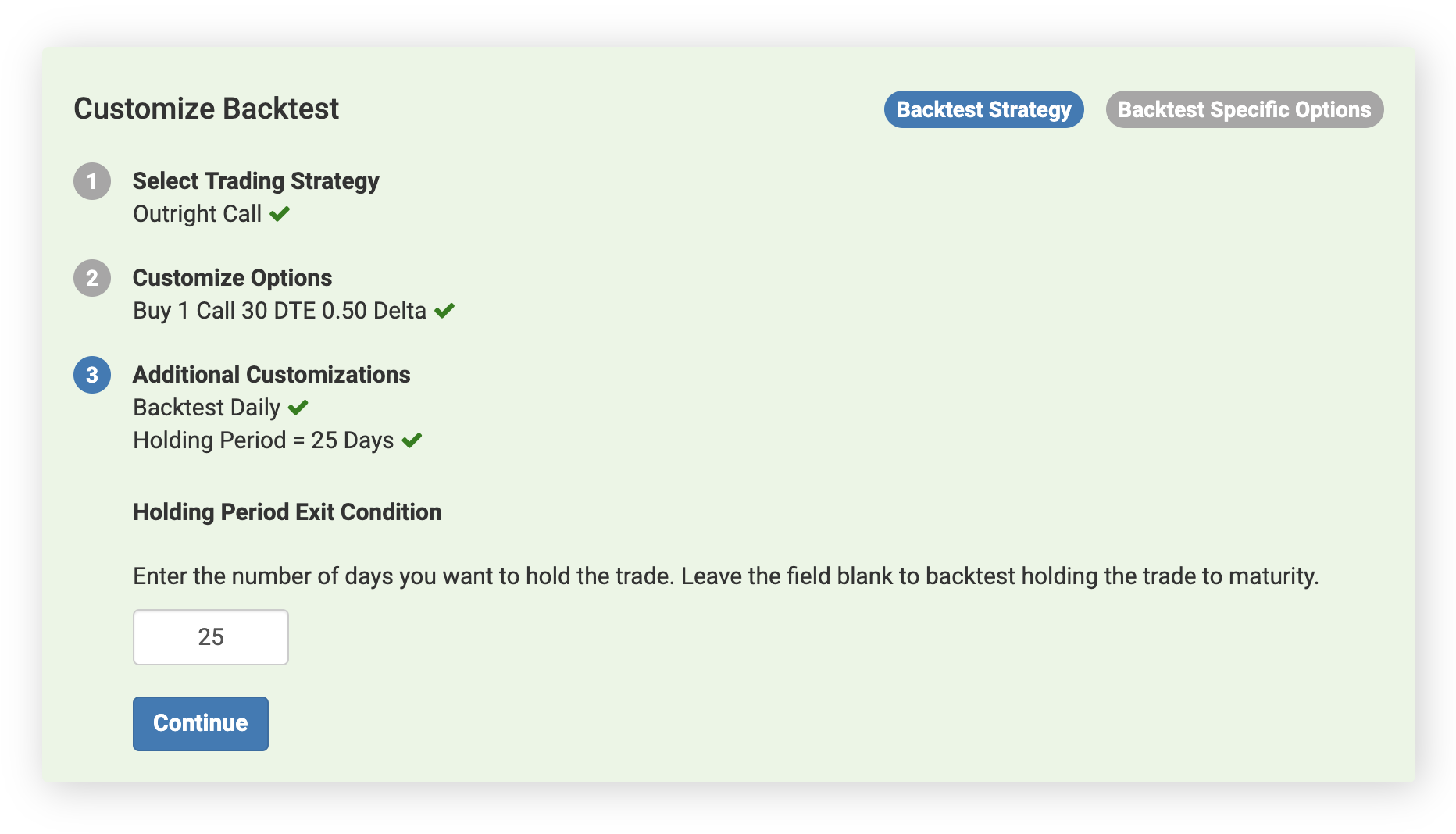

The Holding Period condition allows you to backtest different exits defined by time held, or the number of days between the initiation and the exit of a strategy. For example, if you are backtesting a call option strategy that expires in 30 days, setting a holding period of 25 days in the Backtester will model exiting the trade after 25 days, 5 days before expiration. This value is flexible and can be any value less than or equal to the largest days to expiration value in your options strategy.