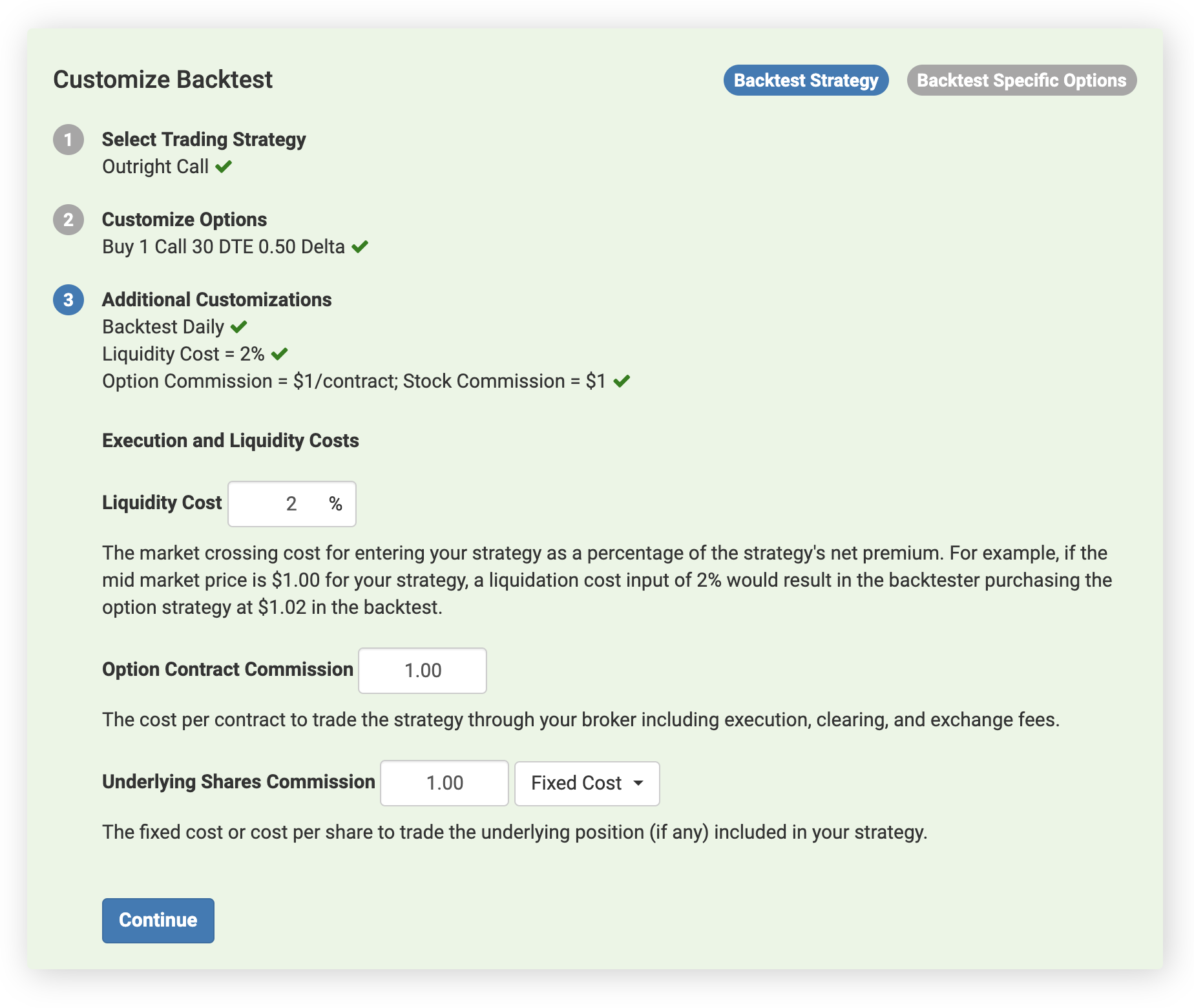

Execution and Liquidity Costs

You can incorporate expected execution and liquidity costs into your backtesting results.

Execution Costs

Execution costs include the transactional fees you may incur in order to implement your options strategy. Your brokerage commission may include execution, clearing, and regulatory fees. You can input these fees as a total value per options contract and per underlying share or futures contract into the "Execution and Liquidity Costs" section of the Additional Customizations. Each trade in your backtest will now incorporate these costs. These costs are saved for future backtests so you do not need to enter them again.

Liquidity Costs

By default, the Volatility Backtester assumes that you can enter your options strategy at the prevailing historical modeled mid price. While these are the theoretical fair values for options, you may not be able to actually transact at these values due to liquidity and market crossing costs. These costs will differ depending on the customer and their execution style and volume of contracts. You can include a liquidity cost to incorporate into the backtest an estimate of your market crossing cost. A common example is 2%, where if the mid fair value of an options contract is $1.00, the backtest would model purchases at $1.02 and sales at $0.98.