Covered Call Screen

Selling calls while holding the underlying stock, or covered call strategies, allow a stockholder to collect premium so long as the underlying stock stays below a certain price. Covered call traders often look for opportunities where they can collect higher premium than average on stocks where realized volatility is expected to be lower than implied volatility and where they believe the stock is not expected to rise above the sold call's strike price. This combination of market dynamics can lead to enhanced covered call profitability, and the Volatility Covered Call Screen helps you identify these opportunities in seconds.

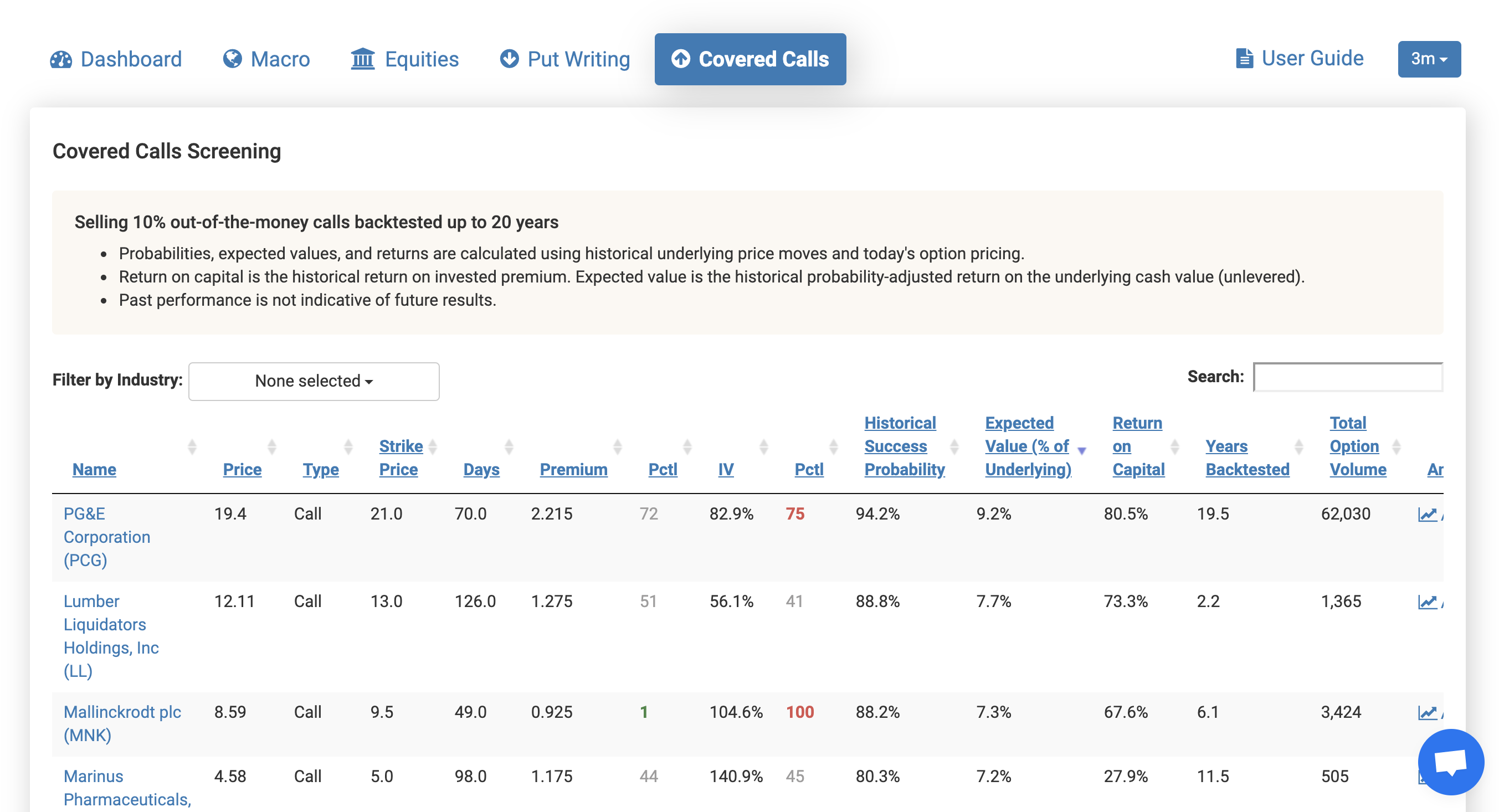

The platform backtests covered calls for each eligible stock in the Volatility universe and displays the results to you in an easily sortable and searchable table. The Covered Call Screen shows backtesting results including call premiums and implied volatilities with their historical percentiles, historical probability of success of writing the call, expected value of writing the call (backtested average P&L as a percentage of the underlying’s price), and return on capital (percentage of premium collected as average backtested profit).

This screen is sortable by each of these metrics to help you find the trades that are attractive to you. For example, you can quickly sort to find the stocks with the highest historical probability of success of covered call writing. By default, the Covered Call Screen shows you opportunities that maximize backtested return on capital for three-month option expiries. You can change the option expiry used in the screen by clicking the dropdown menu in the top right of the page.