Correlation Analysis

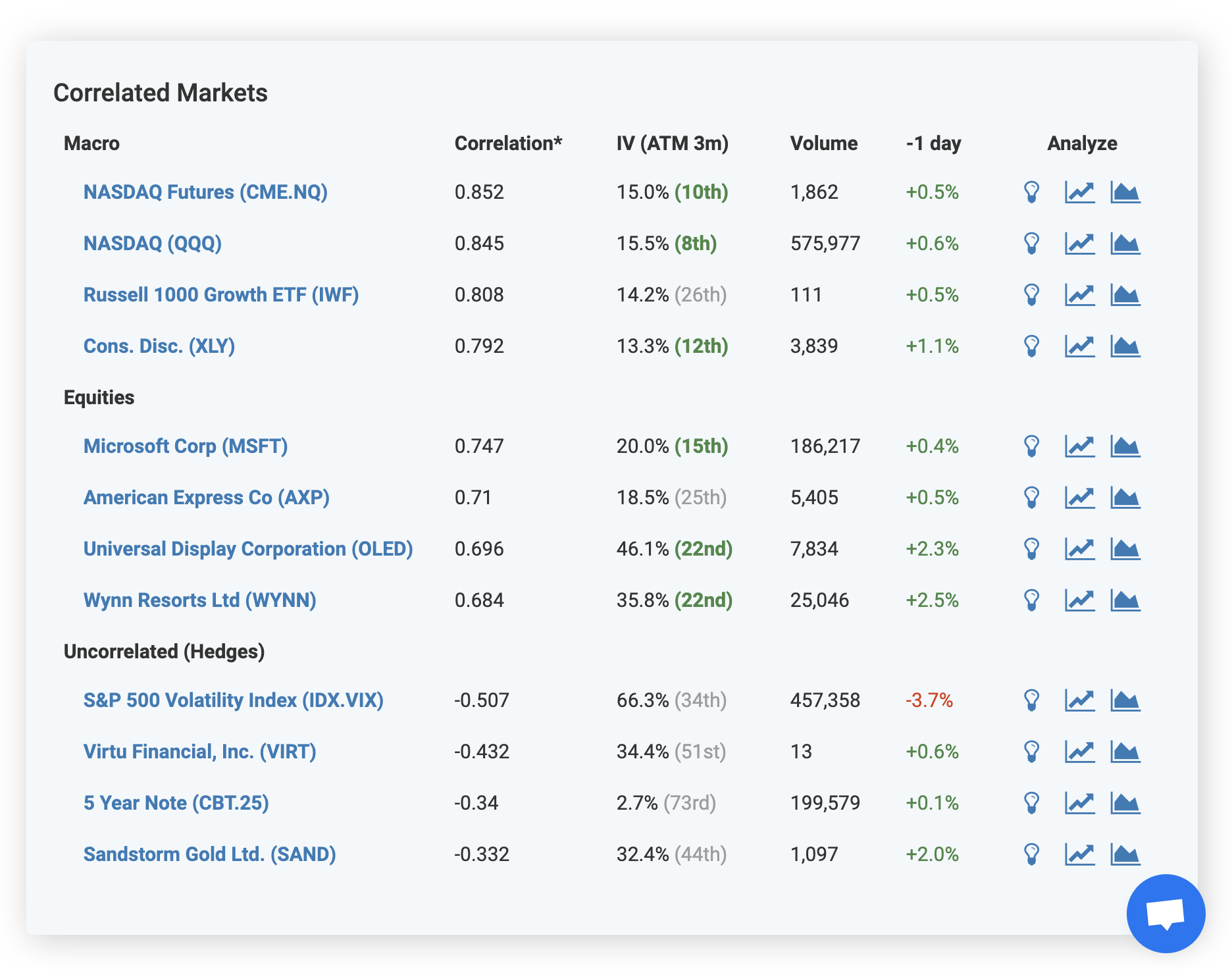

Volatility maintains a large correlation database and provides you with key data from it to improve your trading decisions. Correlation measures the degree to which two stocks move together. On each market’s Opportunities page, Volatility shows the top four macro and equity markets that are positively correlated with it. This is particularly useful for finding other markets that provide similar risk exposures at much more attractive pricing.

For example, if you’re looking to sell a strangle on the S&P 500 (SPY) and see in the Correlated Markets section that the Dow Jones (DIA) has a 0.90 correlation with much higher implied volatility and higher option premiums, you may opt to sell your strangle on DIA instead. You can further leverage the Volatility platform to backtest both trading ideas to find the one that’s right for you.

In the Correlated Markets section, Volatility also displays uncorrelated markets which could make for effective hedges on the current asset. Be sure to check here for the cheapest and most effective hedging opportunities if you’re looking to purchase protection on an asset.