What options say about today's Apple earnings

26 Jan 2016The scale at which Apple operates is mind-boggling – 75 million iPhones expected to have been sold in Q4 alone! Having said that, the stock market has taken a cold shoulder to Apple with the stock selling off 20% over the past six months.

The options market is pricing in a 6.6% move for Apple through Friday with Q4 results announced later today. This expected move is on the high end of what’s normally expected for a holiday quarter. In 2015 traders priced in a 6.8% move, 2014 5.2%, 2013 7.2%, 2012 5.4%, and 2011 4.4%.

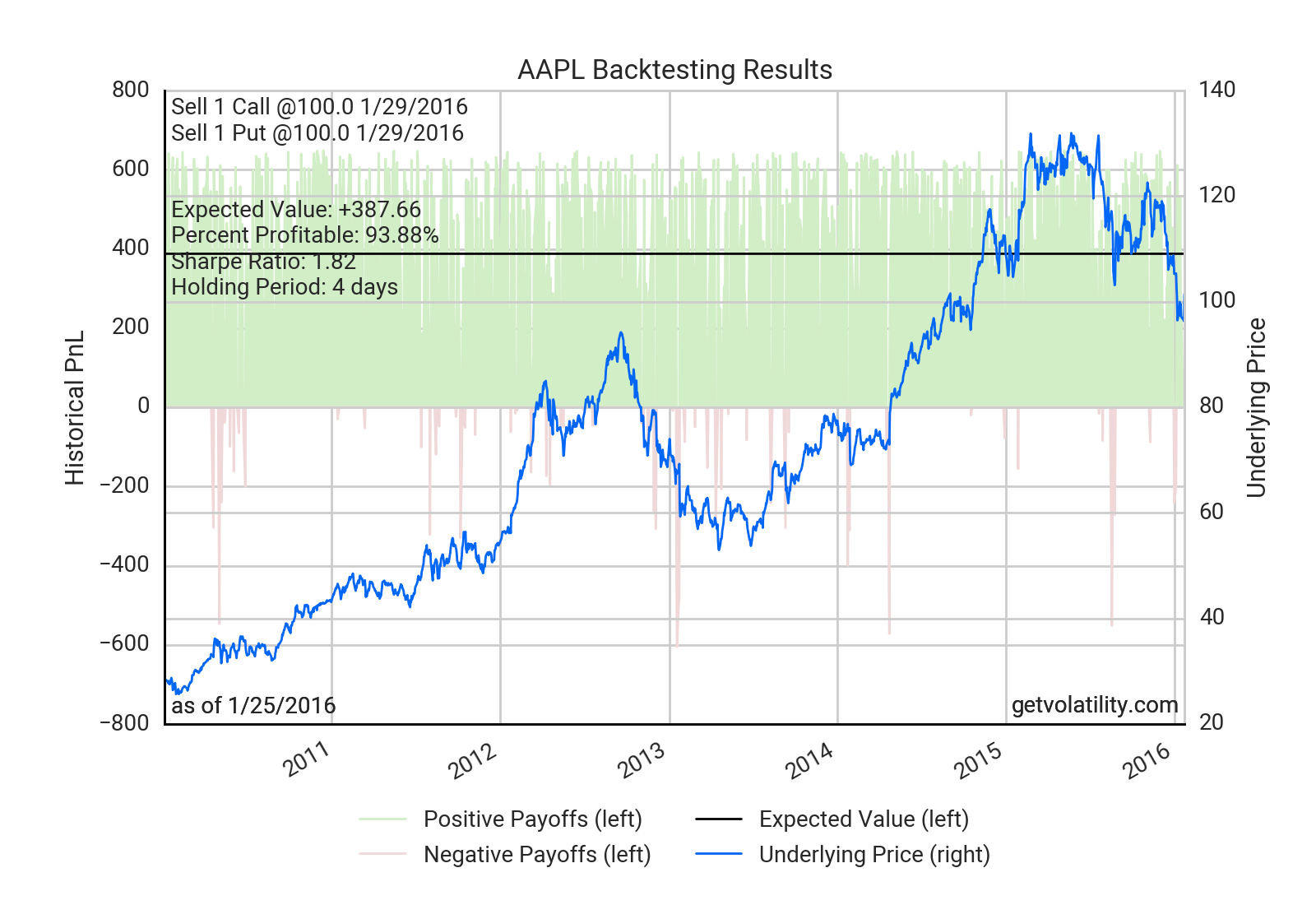

Selling the Jan 29 straddle is not for the faint of heart, but it offers a nearly 1:1 risk/reward of max gain to max loss on a backtested historically realized basis since 2010. The largest loss would have been after 2012’s Q4 results were reported in January 2013. Potential loss on a straddle is of course unlimited.

The chart below visualizes a backtest of selling the weekly AAPL straddle at today’s pricing. Volatility beta users can analyze the straddle trade further here. You are welcome to join our free beta if you don’t have an account.