Announcing more powerful backtests and a new design

19 Jan 2016Happy new year! We’ve been hard at work on new features and are excited to announce our latest big update to Volatility’s Backtester and a new design.

A backtester that’s twice as powerful

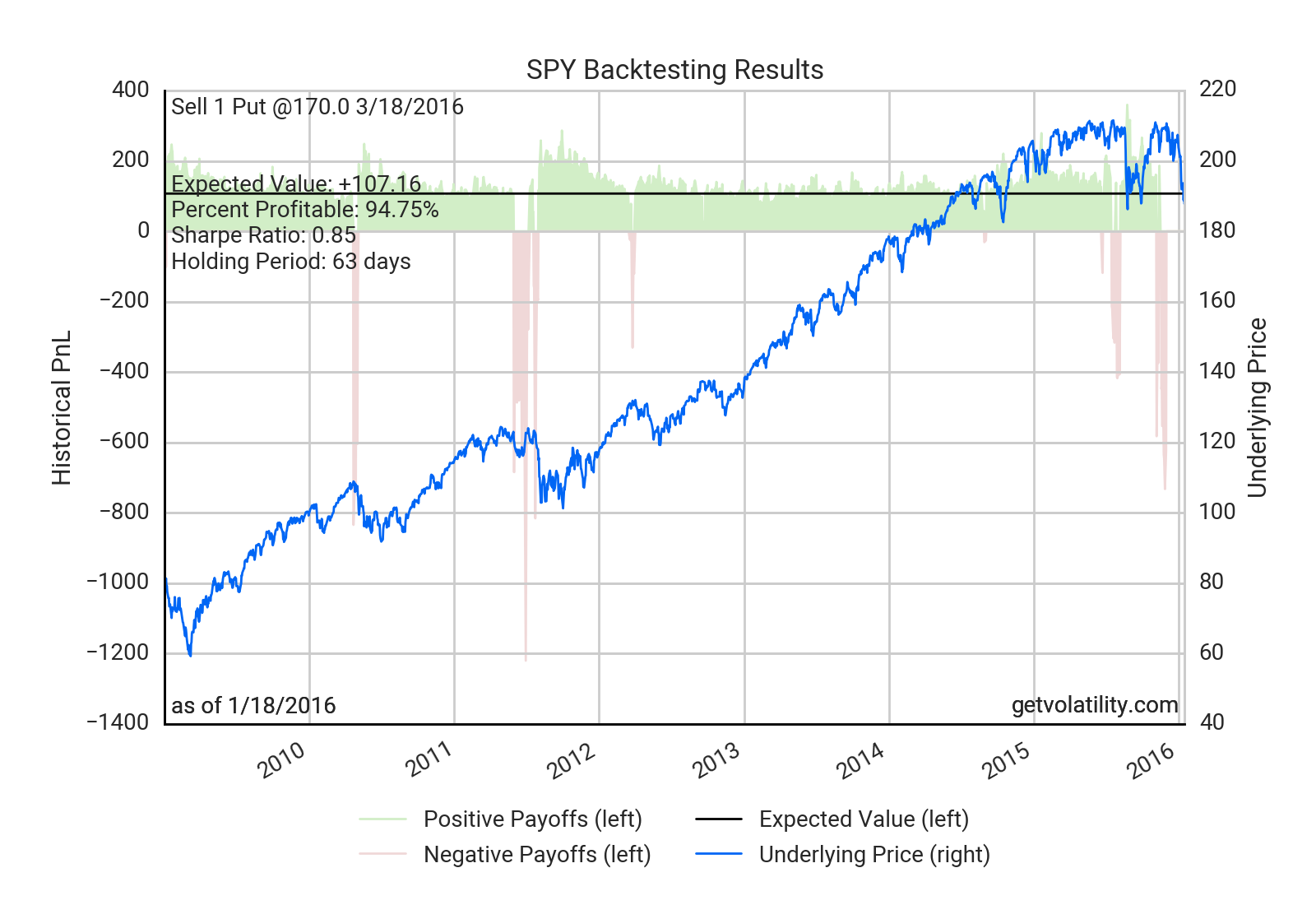

The new Backtester will help you rapidly answer two crucial trading questions for each trade. First, is the strategy attractively priced today? And second, does it have persistent systematic edge over time? Use the new Calculation Method setting to toggle between these two kinds of backtests.

As an example, if I were looking to sell puts on the S&P 500, the “today’s prices” Calculation Method would show whether pricing today is unusually attractive relative to history. The “systematic strategy” method would show whether selling puts recursively performed well in the past. Both provide crucial insight into the potential profitability of my strategy.

Early users of the new backtester have noted that what previously took them hours in clunky spreadsheets now only takes them seconds with Volatility. Try it now and tell us what you think.

Simpler workflows and site navigation

We have redesigned Volatility to be more intuitive and make navigation more fluid and unified. The idea generation, backtesting, and charting pages are now responsive tabs on the same page. Most important, we’ve also added a universal Start bar, which with just a few keystrokes will launch any part of Volatility for any symbol from anywhere. Of course, we also made everything cleaner and prettier.

We’d love to hear what you think of these updates.