Great Fed expectations

15 Dec 2015The last time the Fed seemed close to liftoff from zero rates, the Chinese stock market dropped sharply and fears of contagion held the central bank back. This time around, we have cratering oil prices and scarily illiquid credit markets, but the Fed’s signaling and strong economic growth have kept the futures market unfazed. Futures are currently pricing in a 76% chance of a hike Wednesday. We think it’s interesting to look at what options are pricing in for market moves this week across equities, interest rates, and commodities to understand how much the Fed decision might impact asset prices in the short-run.

Equities

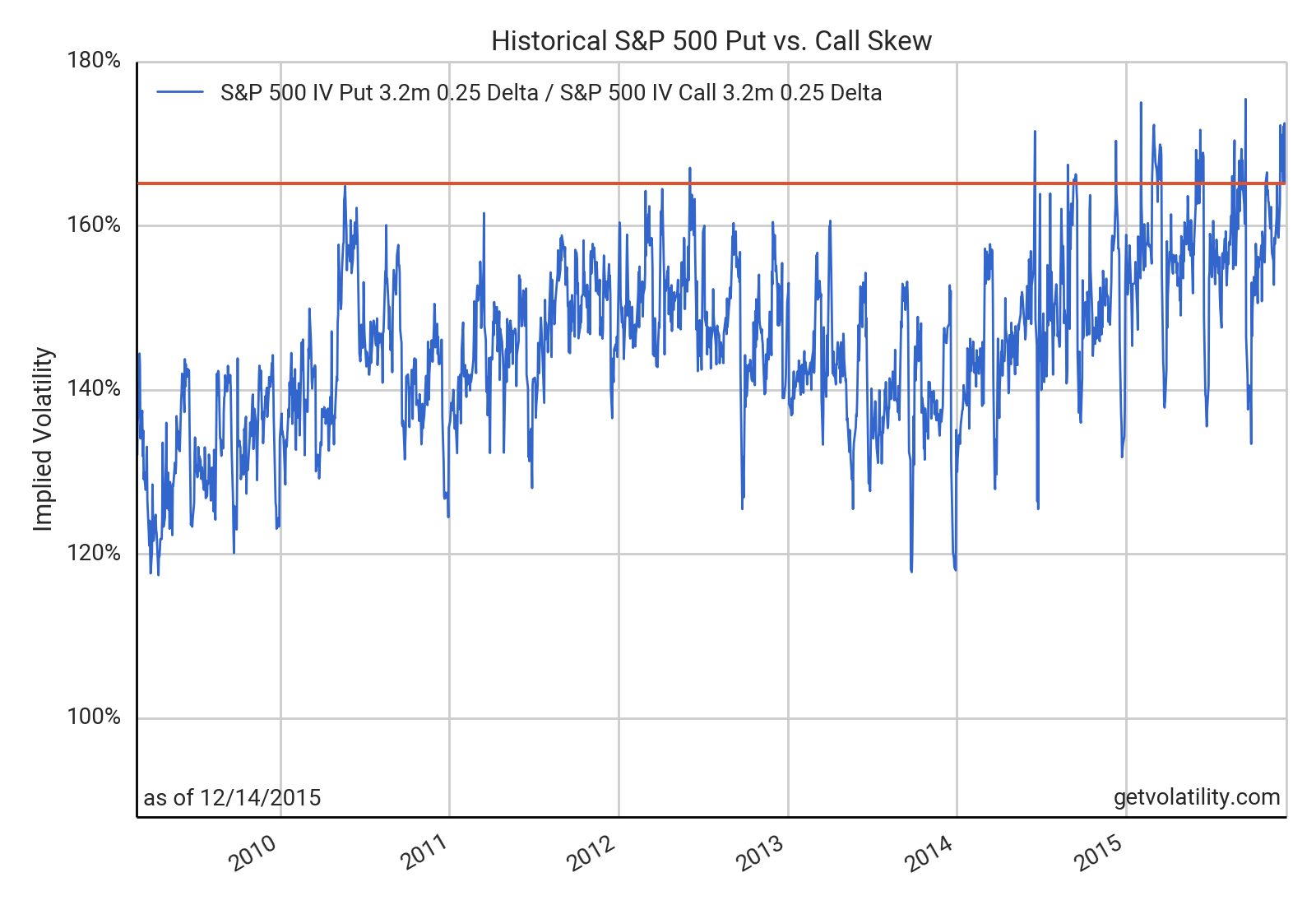

The options market expects a 2.4% S&P 500 move by Friday. In the 206 weeks since 2012, only 22 have realized moves that large. A much larger 5% move is expected in Emerging Markets. Demand for put protection relative to call upside is near the highest level since the Financial Crisis (illustrated with the S&P 500 skew chart below).

Crude oil

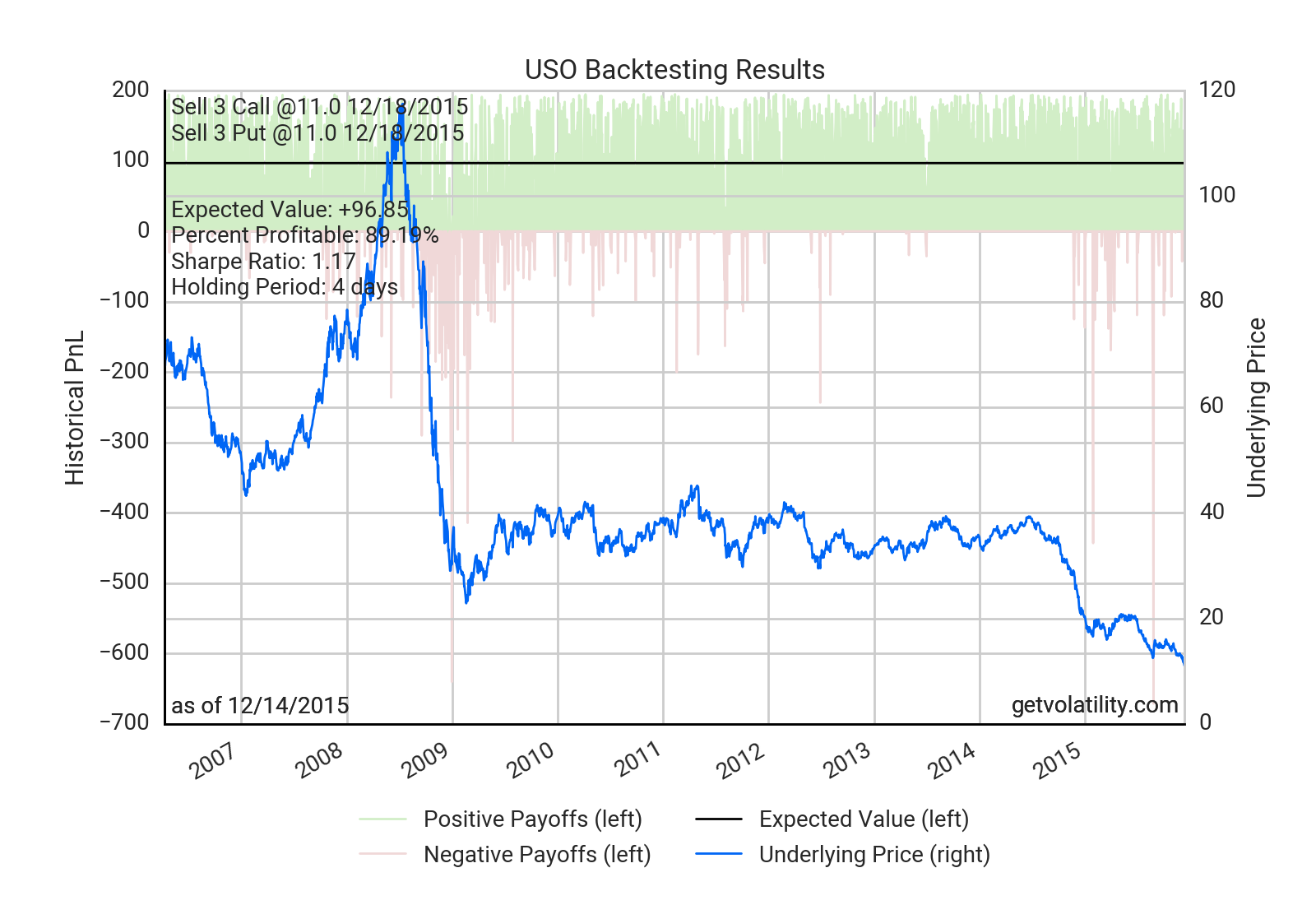

USO options are pricing in a 4.8% move by Friday. Oil has moved less than that over four trading days 89% of the time since 2006 (backtest below) and 85% of the time over the past year.

High yield credit

High yield credit (HYG) has a 2.0% move by Friday priced in, a 90th percentile occurrence.

U.S. rates

U.S. 10y bonds currently yield 2.27% and options are priced for them to stay within 2.21%-2.33% by Friday.