The market expects a big Netflix move this week

11 Oct 2015The options market is expecting an unusually large move in Netflix (NFLX) stock after Q3 earnings are released this coming Wednesday. Expectations priced into options haven’t been this high for an October earnings report since four years ago in 2011 when the stock rose ~30% in the month after the release.

Reversal expected?

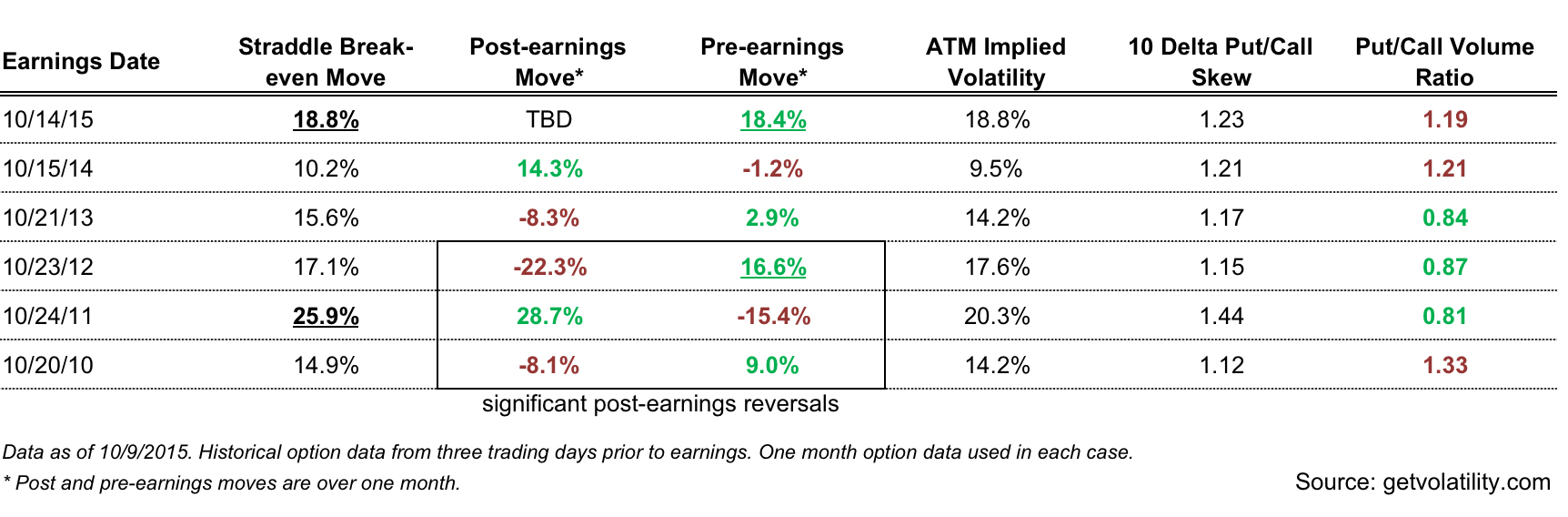

Netflix has risen 18.4% over the past month and has had >9% moves in advance of Q3 earnings in three of the five past years (2012, 2011, and 2010). But in each of those three past occurrences, the post-earnings move has reversed the pre-earnings move (table below). Could traders be positioning for history to repeat? Option volume has been bearish with 1.2x as many puts trading than calls for November 20 expiry.

Options anticipate an unusually big move

Option prices imply a very wide range of $92.02 to $134.64 for NFLX over the next month. Straddle breakevens (the amount NFLX needs to move for option volatility sellers to start losing money) are at 18.8%, the highest level for October earnings since 2011 when it was 25.9%.

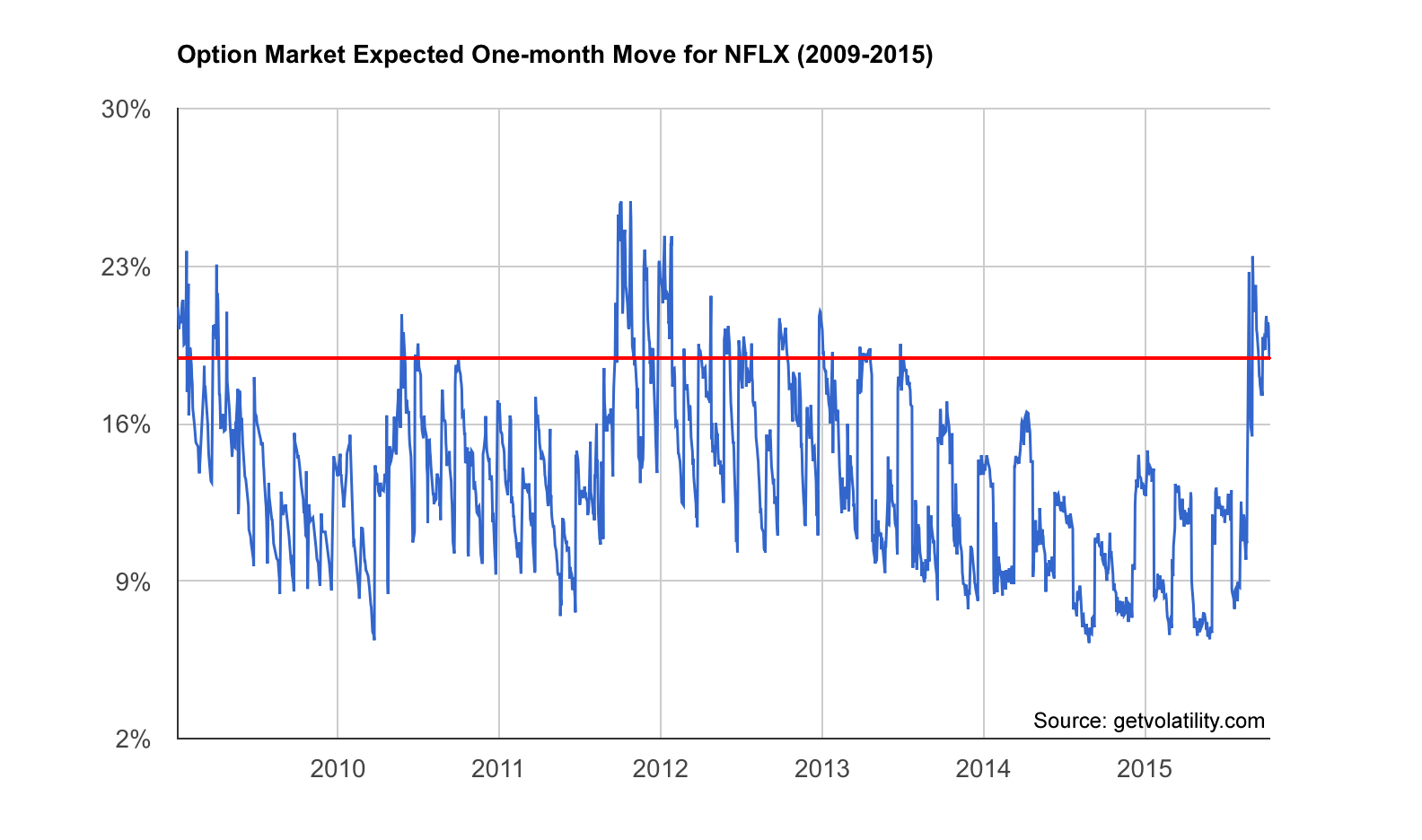

The chart below from Volatility shows the market expectation for a one-month move in NFLX going back to 2009. The market’s current expectation of 18.8% is in the 90th percentile going back to 2009 and is almost the maximum occurrence since early 2013. While selling straddles at this pricing would have been historically profitable 64% of the time over the entire six year range, it would only have been successful for three out of the five past Q3 earnings releases.

Option pricing points to a big week for Netflix. Share what you think will happen in the comments below!

Data source: Volatility, @getvolatility